Monthly Housing Update

A comprehensive overview of monthly property sales activity for the Greater Houston area as recorded in the MLS.

Multiple Listing Service of the Houston Association of REALTORS® includes residential properties and new homes listed by 50,000 REALTORS®

DECLINES IN HOUSTON HOUSING EASE A BIT IN MAY

Market sees further price stabilization as it finds balance

HOUSTON — (June 14, 2023) — May became the Houston housing market’s 14th consecutive month of negative home sales, but the decrease in volume was the smallest in almost a year. That and moderating declines in other market readings may be an indication that the worst of the housing sales slowdown is over, provided there are no further hikes in mortgage interest rates – a major deterrent to home purchases in Houston and across the country through the latter half of 2022 and all of 2023.

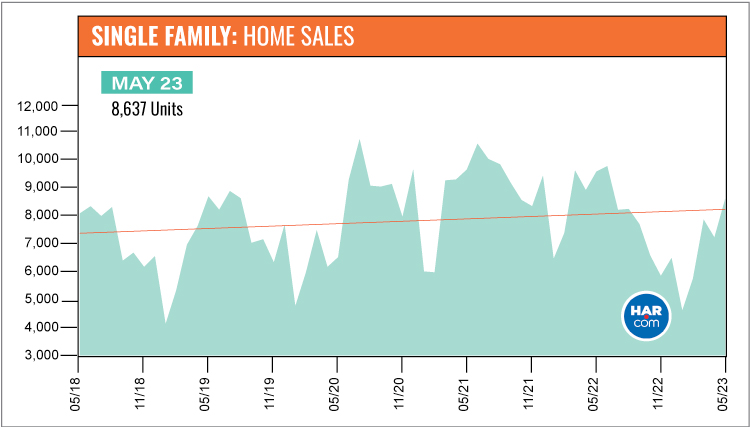

According to the Houston Association of Realtors’ (HAR) May 2023 Market Update, single-family home sales were down 10.4 percent year-over-year with 8,637 units sold compared to 9,641 in May 2022. That is the smallest drop since June 2022 when volume was down 7.6 percent. When compared to pre-pandemic May 2019, home sales were down just 1.3 percent. In addition, inventory remains well above the historic lows of 2022, presenting more options for prospective buyers as we move deeper into the traditionally busy homebuying season.

All but the sub-$100,000 housing segment experienced declines in May when compared to 2022. Single-family rentals benefited again from strong consumer demand as many would-be homebuyers continued to scoop up rental homes amid uncertainty about interest rates and inflation. HAR will publish its May 2023 Rental Home Update next Wednesday, June 21.

“Houston housing has been in negative territory for 14 months, however this latest report showed a notable easing in declines and may be a bellwether of improving market conditions ahead,” said HAR Chair Cathy Treviño with Side, Inc. “Unfortunately, there still are looming influences out there that remain out of our control, including interest rates, a possible deepening of inflation or a drift toward recession. Any one of those could slam the brakes on home sales.”

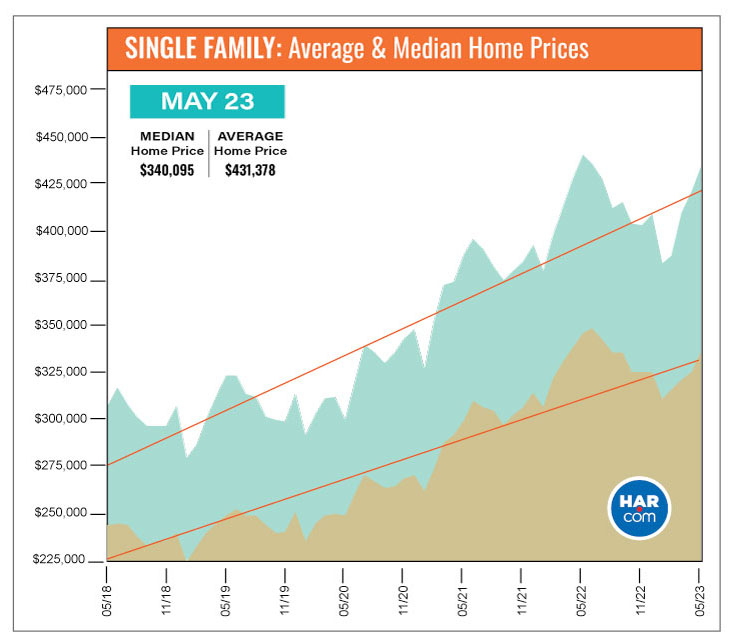

Single-family home prices fell for the fourth time since the spring of 2020. The average price dipped 1.6 percent to $431,378 while the median price fell 3.1 percent to $340,095. That keeps pricing below the record highs of $438,350 (average) in May 2022 and $353,995 (median) in June 2022.

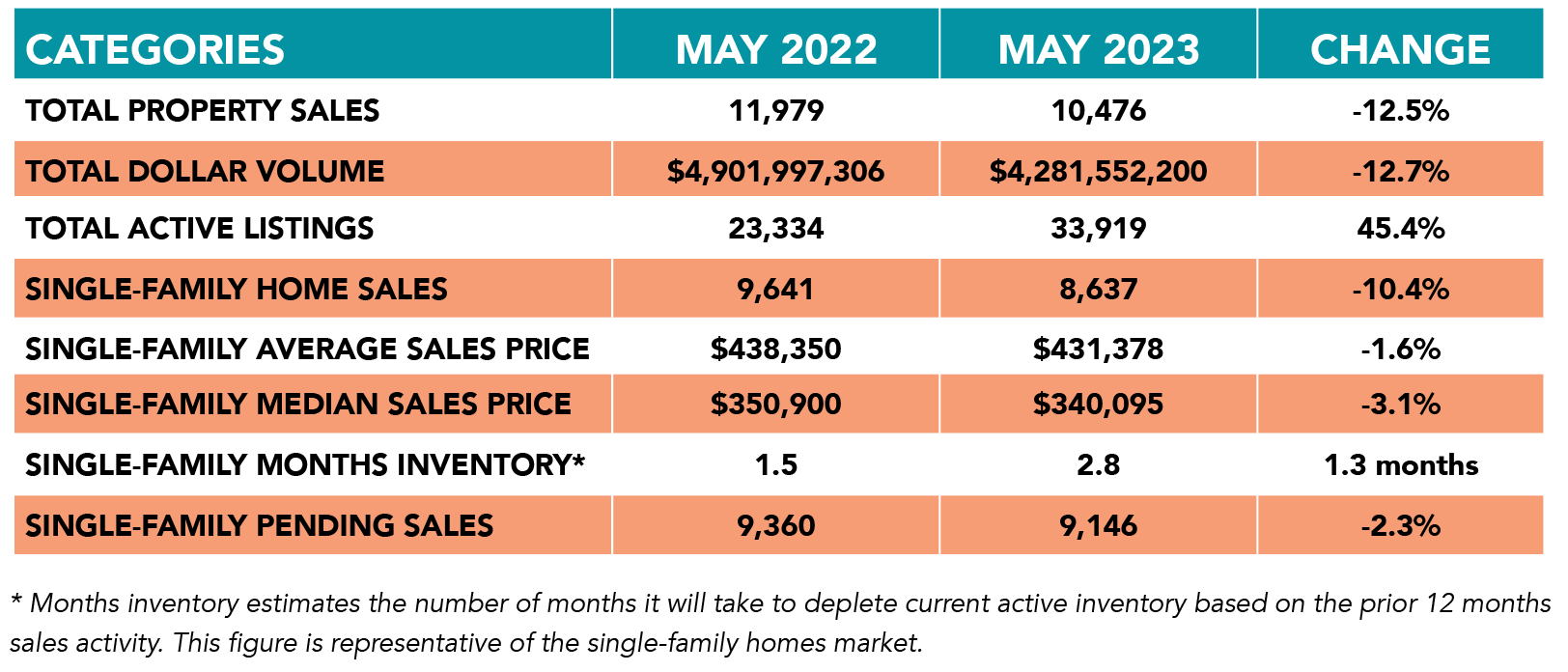

May Monthly Market Comparison

May marked the 14th straight month of negative sales as Houston and real estate markets across the country continue trying to overcome persistent economic headwinds. Year-over-year single-family home sales were down 10.4 percent, but when compared to May 2019, before the pandemic, sales dropped just 1.3 percent, and stacked against May 2018, five years ago, they were up 6.4 percent.

In addition to the drop in single-family home sales, total property sales and total dollar volume also fell below last year’s levels, but at lesser rates of decline than in previous months. Single-family pending sales were down 2.3 percent. Active listings, or the total number of available properties, came in 45.4 percent ahead of the 2022 level.

Months of inventory showed continued improvement in May, expanding to a 2.8-months supply. Housing inventory nationally sits at a 2.9-months supply, according to the latest report from the National Association of Realtors (NAR). A 4.0- to 6.0-months supply has long been regarded as reflecting a “balanced market” in which neither the buyer nor the seller has the upper hand.

Single-Family Homes Update

Single-family home sales fell 10.4 percent year-over-year in May with 8,637 units sold across the Greater Houston area compared to 9,641 in 2022. Pricing continues to moderate after reaching record highs last spring. The May average price fell 1.6 percent to $431,378 while the median price declined 3.1 percent to $340,095. February 2023 marked the first pricing declines the Houston housing market had seen in more than two years.

For a pre-pandemic perspective, May sales were down just 1.3 percent compared to May 2019, when a total of 8,749 single-family homes sold. The May 2023 median price of $340,095 is 36.0 percent higher than it was in 2019 ($250,000) and today’s average price of $431,378 is 34.3 percent higher than it was then ($321,323). Sales are 6.4 percent ahead of where they were five years ago, in May 2018, when volume totaled 8,117. Back then, the median price was $244,015 and the average price was $305,245.

Days on Market, or the actual time it took to sell a home, increased from 30 to 48 days. Months of inventory registered a 2.8-months supply compared to 1.5 months a year earlier. The current national supply stands at 2.9 months, as reported by NAR.

Broken out by housing segment, May sales performed as follows:

- $1 - $99,999: increased 11.1 percent

- $100,000 - $149,999: decreased 12.3 percent

- $150,000 - $249,999: decreased 6.7 percent

- $250,000 - $499,999: decreased 9.4 percent

- $500,000 - $999,999: decreased 15.2 percent

- $1M and above: decreased 15.5 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 6,484 in May, down 16.2 percent from the same month last year. The average price fell 2.6 percent to $431,582 and the median sales price declined 4.6 percent to $334,000.

For HAR’s Monthly Activity Snapshot (MAS) of the May 2023 trends, please click HERE to access a downloadable PDF file.

Townhouse/Condominium Update

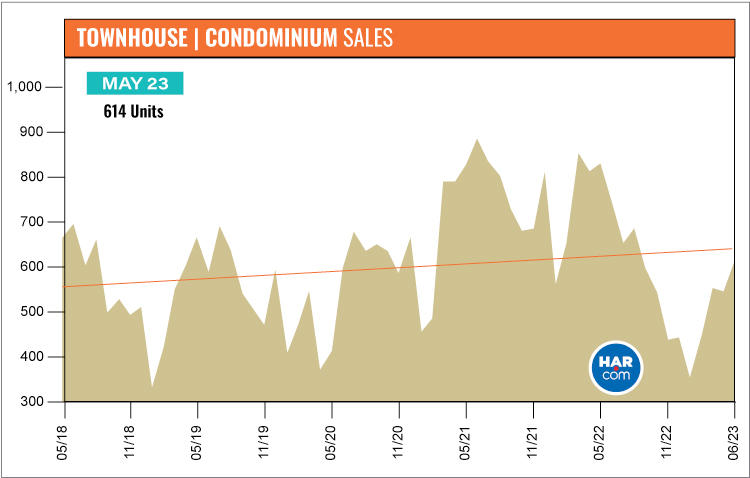

Townhouses and condominiums experienced their 12th consecutive monthly decline in May, falling 26.1 percent year-over-year with 614 closed sales versus 831 a year earlier. The average price fell 3.7 percent to $262,015 and the median price dropped 6.0 to $216,300. Inventory grew from a 1.3-months supply to 2.6 months, the highest level since March 2021.

Compared to pre-pandemic May 2019, when 665 units sold, townhome and condominium sales were down 7.7 percent. The average price back then, at $211,346, was 24.0 percent lower and the median price, at $171,604 was 26.0 percent lower.

Houston Real Estate Highlights in May

- Single-family home sales were down 10.4 percent year-over-year, the 14th consecutive month of slowing sales volume but the lowest rate of decline since June 2022, suggesting that improved market conditions may be looming;

- Compared to pre-pandemic 2019, single-family home sales were down just 1.3 percent, however they were up 6.4 percent versus the volume five years ago, in May 2018;

- All housing segments experienced sales declines except homes priced below $100,000;

- Days on Market (DOM) for single-family homes rose from 30 to 48 days;

- Total property sales fell 12.5 percent with 10,476 units sold;

- Total dollar volume dropped 12.7 percent to $4.3 billion;

- The single-family median price dropped 3.1 percent to $340,095;

- The single-family average price fell 1.6 percent to $431,378;

- Single-family home months of inventory registered a 2.8-months supply, up from 1.5 months a year earlier;

- Townhome/condominium sales experienced their 12th straight monthly decline, falling 26.1 percent, with the median price down 6.0 percent to $216,300 and the average price down 3.7 percent to $262,015;

- Compared to pre-pandemic 2019, townhome and condominium sales were down 7.7 percent.