Monthly Housing Update

A comprehensive overview of monthly property sales activity for the Greater Houston area as recorded in the MLS.

Multiple Listing Service of the Houston Association of REALTORS® includes residential properties and new homes listed by 50,000 REALTORS®

THE HOUSTON HOUSING MARKET DEFIES A PANDEMIC TO SET NEW RECORDS IN 2020

Real estate’s designation as an ‘essential service’ was the key as Realtors provided critically needed housing to consumers throughout the year

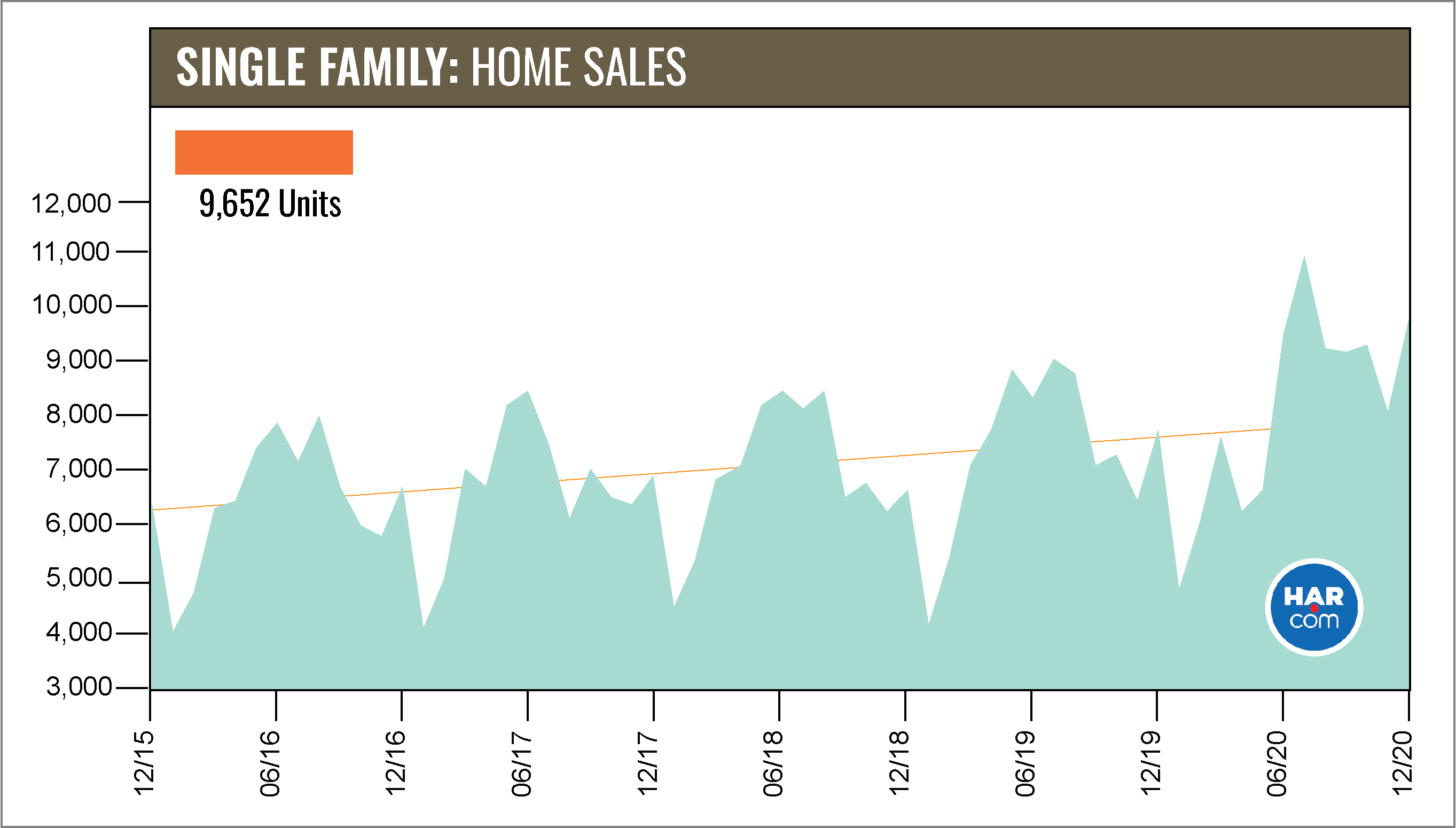

HOUSTON — (January 13, 2021) — Not even a devastating global pandemic could stop the Houston real estate market from shattering records as it crossed the finish line for the 2020 calendar year. Single-family home sales surpassed 2019’s record volume by more than 10 percent, even as the supply of homes withered to the lowest levels of all time.

Stay-at-home orders resulting from the COVID-19 outbreak interrupted local real estate activity during March and April. However, the designation of real estate as an ‘essential service’ shortly thereafter enabled Realtors to resume working with would-be homebuyers looking to take advantage of historically low mortgage interest rates. Realtors also assisted consumers seeking rental properties across the greater Houston area. Even as stay-at-home orders were eventually lifted, virtual technology developed by the Houston Association of Realtors (HAR) made it possible for consumers to attend open houses and property showings remotely, without putting their health at risk. By the time 2020 was over, April and May emerged as the only negative sales months, as the market rebounded over the summer and gained momentum each month for the rest of the year.

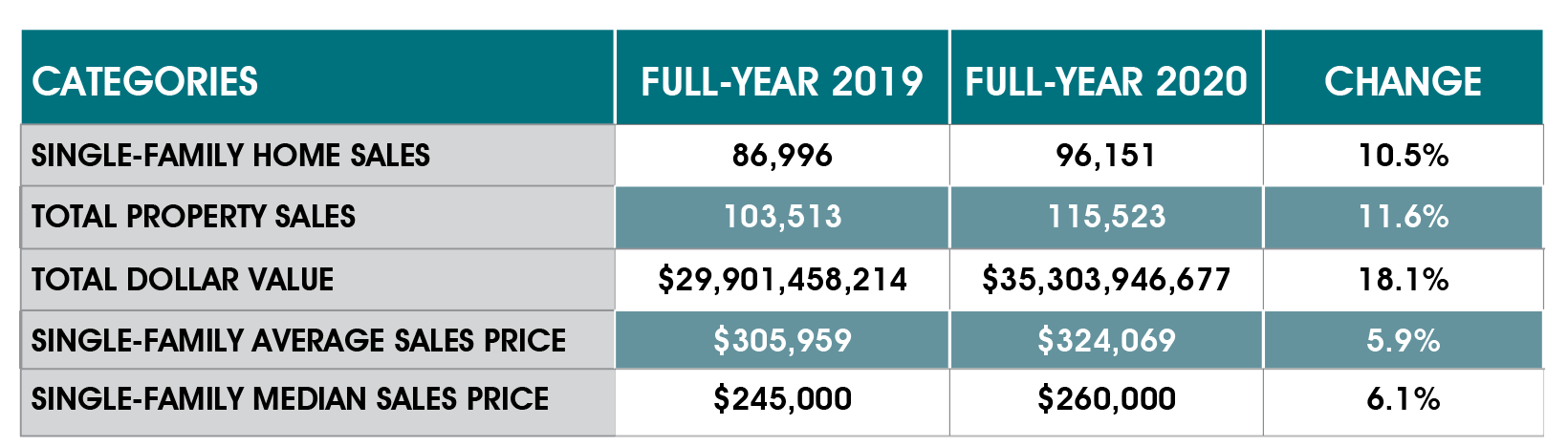

According to HAR’s 2020 annual market report, single-family home sales rose 10.5 percent to 96,151. Sales of all property types for the year totaled 115,523. That represents an 11.6-percent increase over 2019’s record volume and marks only the second time in history that total property sales broke the 100,000 level. Total dollar volume for 2020 shot up 18.1 percent to a record-breaking $35.3 billion.

“When the coronavirus pandemic struck, we expected the real estate business to hit a brick wall and never fathomed the possibility of 2020 becoming a record year for the Houston market,” said HAR Chairman Richard Miranda with Keller Williams Platinum. “HAR worked closely with elected officials to secure the ‘essential service’ designation for real estate, which cleared the way for our hard-working Realtor members to help consumers find the homes they needed. HAR’s virtual open house and virtual showing technology proved invaluable in enabling consumers to safely tour the properties that interested them. As we enter 2021, we find ourselves in critical need of inventory if we are to sustain a healthy pace of home sales,” added Miranda.

Single-family home sales for the month of December jumped 25.5 percent compared to December 2019. The strongest sales activity took place among homes priced between $500,000 and $750,000, which rocketed 80.8 percent. The luxury market, consisting of homes priced at $750,000 and up, came in second place, climbing 54.0 percent. That was followed by homes in the $250,000 to $500,000 range, which rose 44.6 percent.

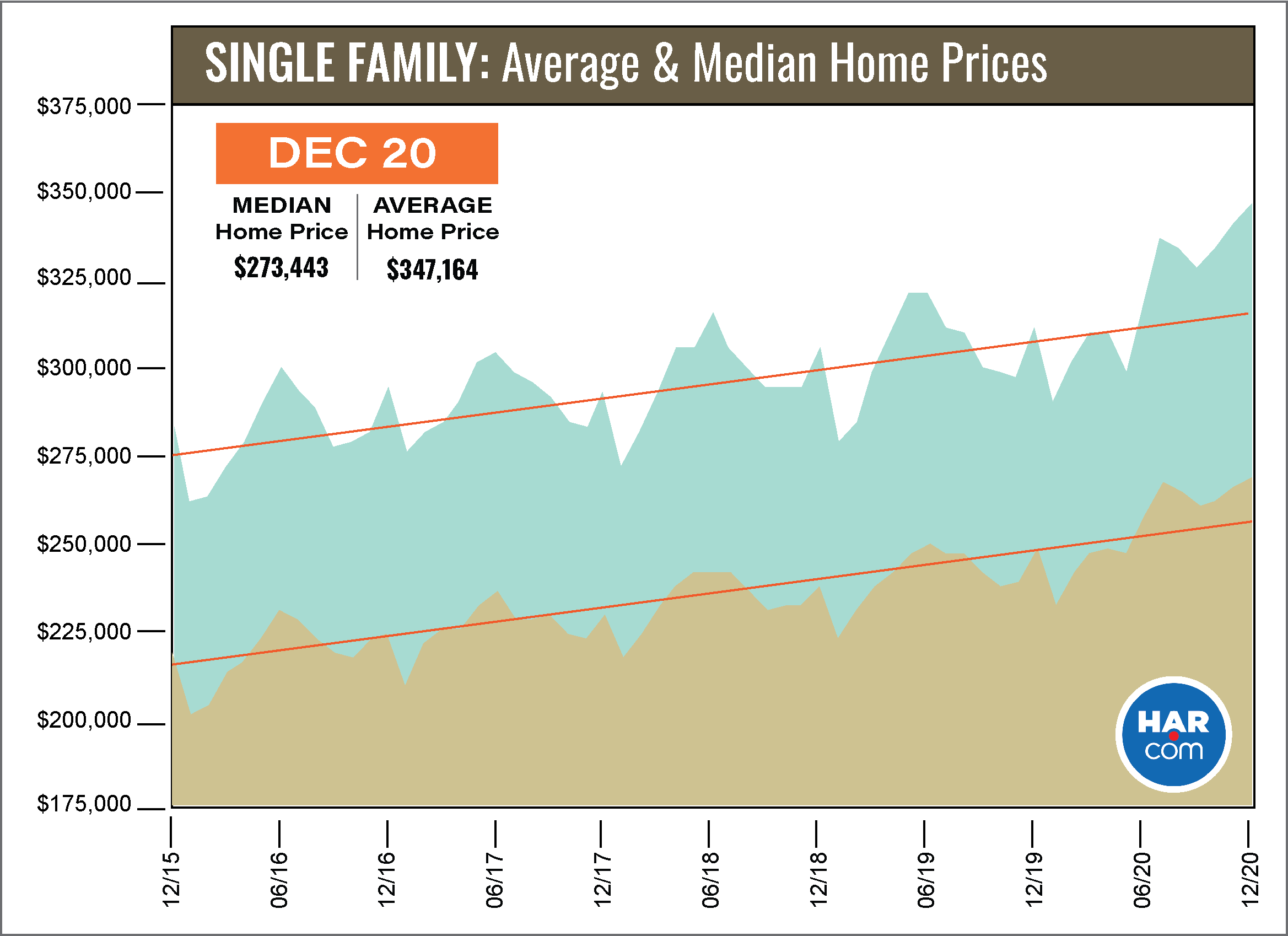

Prices of single-family homes established new December highs. The median price – the figure at which half of the homes sold for more and half sold for less – rose 8.7 percent to $273,443 while the average price rose 11.4 percent to $347,164..

2020 Annual Market Comparison

The Houston real estate market entered 2020 carrying positive momentum from 2019, but faced shrinking inventory resulting from a combination of brisk sales and a dwindling supply of new listings. There were also lingering concerns about possible fallout from widespread layoffs within the energy industry. Nevertheless, sales held to positive territory for the first three months of the year until the COVID-19 pandemic struck, sending sales volumes plummeting in April and May as stay-at-home orders temporarily halted real estate activity. The designation of real estate as an ‘essential service’ and HAR’s rollout of virtual technology that enabled consumers to remotely tour listed properties helped the market stage a turnaround in June

.

Sales increased each month for the remainder of 2020, but without new listings to backfill that supply, inventory by year’s end was down to its lowest level in history – a 1.9-months supply. Months of inventory estimates the number of months it will take to deplete current active inventory based on the prior 12 months sales activity. A 6.0-months supply has traditionally been considered to constitute a “balanced market.”

New real estate records were set throughout the year, with July going down as Houston’s greatest one-month sales volume of all time – 10,815 single-family units sold. A record high average price of $347,164 and record high median price of $273,443 were achieved in December.

By the time the books were closed on December transactions, a record 96,151 single-family homes had sold across greater Houston in 2020. That represents an increase of 10.5 percent from the previous record of 86,996 in 2019.

On a year-to-date basis, the average price rose 5.9 percent to $324,069 while the median price increased 6.1 percent to $260,000. Total dollar volume for full-year 2020 jumped 18.1 percent to a record-setting $35.3 billion.

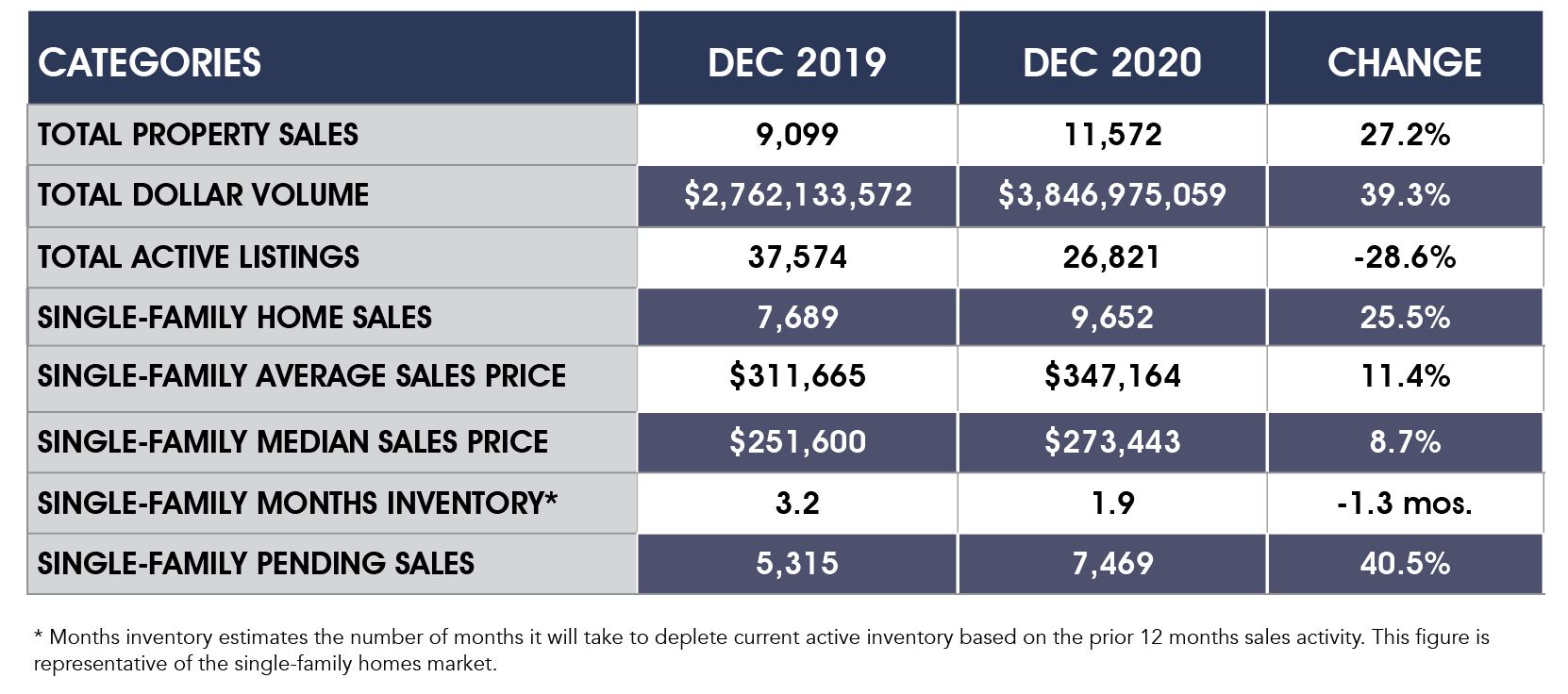

December Monthly Market Comparison

The Houston housing market generated positive readings across the board in December with the exception of active listings and inventory. Single-family home sales, total property sales, total dollar volume and pricing were all up compared to December 2019. Month-end pending sales for single-family homes totaled 7,469, an increase of 40.5 percent versus one year earlier. Total active listings, or the total number of available properties, fell 28.6 percent from a year earlier to 26,821.

Single-family homes inventory narrowed dramatically from a 3.2-months supply to 1.9 months. For perspective, housing inventory across the U.S. currently stands at a 2.3-months supply, according to the latest National Association of Realtors (NAR) report.

For HAR’s Monthly Activity Snapshot (MAS) of the December 2020 trends, please click HERE to access a downloadable PDF file.

December Single-Family Homes Update

Single-family home sales totaled 9,652, a 25.5 percent increase from December 2019. That marked the seventh consecutive month that sales were on the rise. The median price rose 8.7 percent to an all-time high of $273,443. The average price increased 11.4 percent to $347,164 – another record-setting figure. Days on Market (DOM), or the number of days it took the average home to sell, dropped from 63 to 46.

Broken out by housing segment, December sales performed as follows:

- $1 - $99,999: decreased 15.7 percent

- $100,000 - $149,999: decreased 20.2 percent

- $150,000 - $249,999: increased 13.2 percent

- $250,000 - $499,999: increased 44.6 percent

- $500,000 - $749,999: increased 80.8 percent

- $750,000 and above: increased 54.0 percent

HAR also breaks out the sales figures for existing single-family homes. Existing home sales totaled 7,647 in December. That is up 31.6 percent versus the same month last year. The average sales price rose 14.2 percent to $340,400 while the median sales price increased 12.8 percent to $265,000.

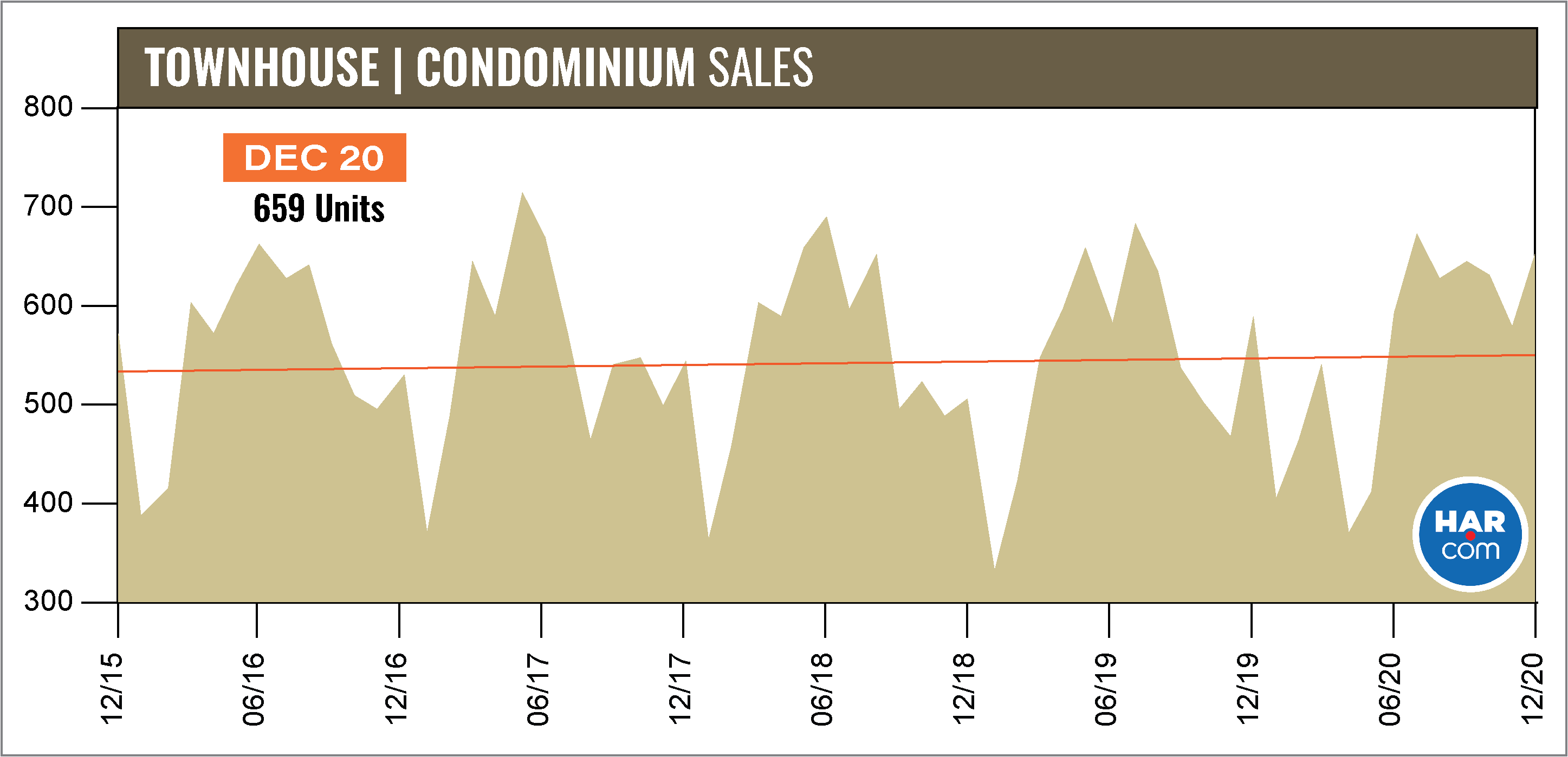

Townhouse/Condominium Update

Townhome and condominium sales staged a strong finish to a year that, as with all other housing types, experienced sharp declines in April and May as a result of the COVID-19 pandemic. December volume rose 10.9 percent with 659 units sold versus 594 a year earlier. The average price was statistically flat at $227,856 while the median price fell 2.7 percent to $180,000. Inventory dwindled from a 3.9-months supply to 3.3 months.

Lease Property Update

Houston’s lease market staged a mixed performance in December. Single-family home leases fell 14.5 percent while townhome/condominium leases rose 13.1 percent. The average rent for single-family homes was up 7.5 percent to $1,899 while the average rent for townhomes/condominiums was up 3.6 percent to $1,641.

Houston Real Estate Highlights for December and Full-Year 2020

- Despite a devastating global pandemic, 2020 proved to be a record year for Houston real estate with 96,151 single-family homes sold versus 86,996 in 2019, the last record-setting year. That represents an increase of 10.5 percent;

- Total dollar volume for full-year 2020 rose 18.1 percent to a record-setting $35.3 billion;

- December single-family home sales jumped 25.5 percent year-over-year with 9,652 units sold;

- Total December property sales increased 27.2 percent to 11,572 units;

- Total dollar volume for December soared 39.3 percent to $3.9 billion;

- At $273,443, the single-family home median price rose 8.7 percent, establishing a new record high;

- The single-family home average price climbed 11.4 percent to an all-time high of $347,164;

- Single-family homes months of inventory narrowed sharply to a record low 1.9-months supply;

- Townhome/condominium sales rose 10.9 percent year-over-year with the average price unchanged at $227,856 and the median price down 2.7 percent to $180,000;

- Leases of single-family homes fell 14.5 percent with average rent up 7.5 percent to $1,899;

- Leases of townhomes/condominiums climbed 13.1 percent with average rent up 3.6 percent to $1,641.