Monthly Housing Update

A comprehensive overview of monthly property sales activity for the Greater Houston area as recorded in the MLS.

Multiple Listing Service of the Houston Association of REALTORS® includes residential properties and new homes listed by 50,000 REALTORS®

HOUSTON’S FRENETIC PACE OF HOME SALES EASES IN OCTOBER

Despite the second sales decline of the year, 2021 is still tracking at record levels

HOUSTON — (November 10, 2021) — Along with the first notable cold front of the fall season, October delivered the inevitable to a hot Houston real estate market: cooling sales. Buyers weary of limited housing inventory apparently stepped back in October, which became the second month of 2021 to experience a decline in home sales. The first was July.

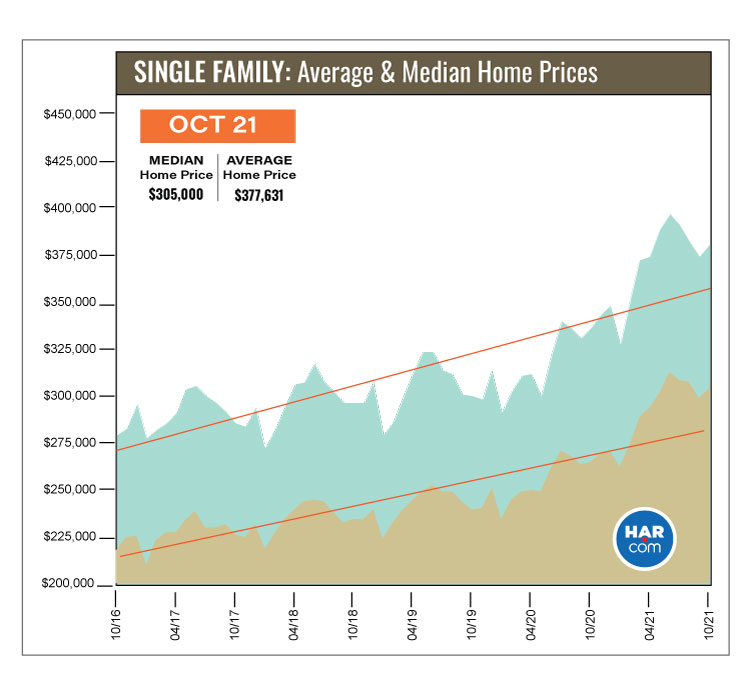

According to the Houston Association of REALTORS (HAR) October 2021 Market Update, single-family homes sales fell 5.2 percent versus last October, with 8,703 units sold. That is down from 9,183 sales in 2020. On a year-to-date basis, however, local home sales are 12.9 percent ahead of 2020’s record pace and up 21.6 percent when compared to 2019, the previous record-setting year.

Homes priced from $500,000 to $1 million drew the greatest sales volume increase for the month, scoring a 23.1 percent year-over-year increase. The luxury market – comprised of homes priced from $1 million and above – came in second place with a 20.4 percent gain. That was followed by the $250,000 to $500,000 housing segment, which rose 17.5 percent.

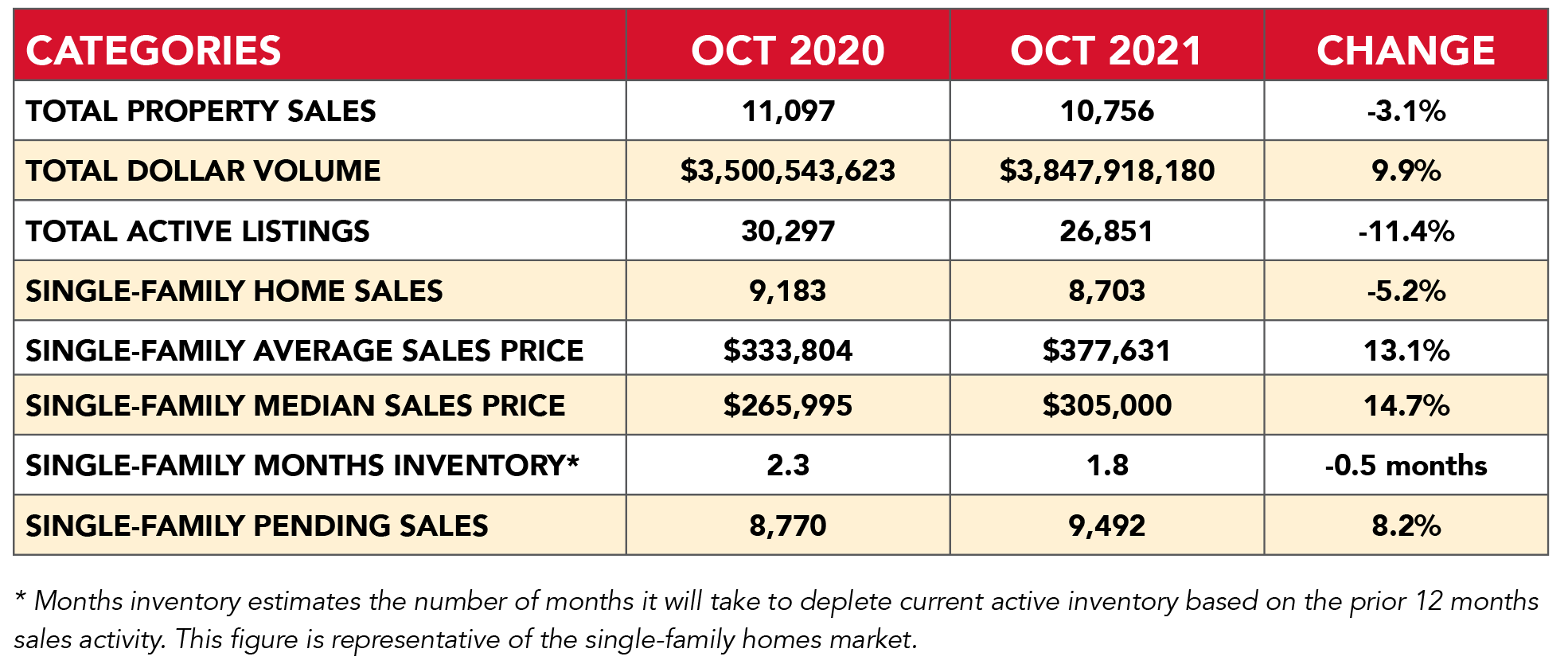

Prices appreciated once again. The single-family home average price climbed 13.1 percent to $377,631 while the median price rose 14.7 percent to $305,000. Both are record prices for an October but are well below the all-time pricing highs set in June 2021.

Sales of all property types were down 3.1 percent year-over-year, totaling 10,756. Despite that decline, total dollar volume for October increased 9.9 percent to $3.8 billion.

“Housing markets move in cycles, especially after churning at record levels for months on end, and we cannot rule out the possibility that some homebuyers are holding off until there is more inventory from which to choose,” said HAR Chairman Richard Miranda with Keller Williams Platinum. “Existing home sales were actually flat in October while new construction declined, and that is most likely the result of the supply chain interruptions and labor shortages that have affected homebuilding across the country. Nevertheless, 2021 is still on track to be a record year for Houston home sales.”

Lease Property Update

Houston’s lease market had a mixed October performance. Single-family lease homes fell 3.4 percent year-over-year. Leases of townhomes and condominiums increased 1.3 percent. The average single-family rent climbed 9.7 percent to $2,092 while the average rent for townhomes and condominiums increased 7.3 percent to $1,712.

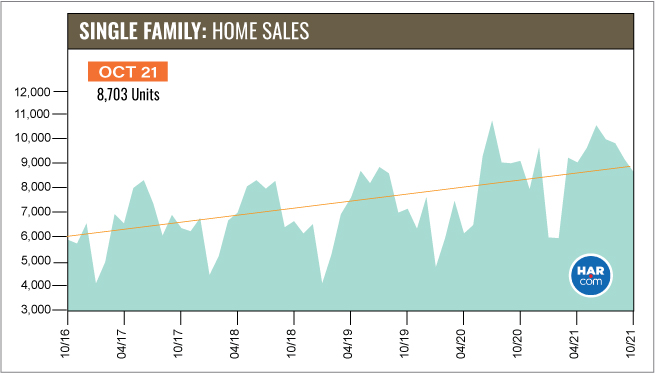

October Monthly Market Comparison

The Houston real estate market experienced its second decline of 2021 in October with homebuyers appearing to hit the pause button until inventory levels improve. The first decline took place back in July. Pending sales increased 8.2 percent. However, total active listings — or the total number of available properties —remains down 11.4 percent compared to 2020 following strong buying trends earlier this year.

Single-family homes inventory reached a 1.8-months supply. While that is down from 2.3 months last October, it is the market’s greatest supply of homes of 2021. Housing inventory nationally stands at a 2.4-months supply, according to the latest report by the National Association of REALTORS (NAR).

Single-Family Homes Update

Single-family home sales fell 5.2 percent in October with 8,703 units sold across the greater Houston area compared to 9,183 a year earlier. Strong sales volume among homes at the high end of the market pushed up pricing, however it remained below June’s record-setting pricing. The single-family home average price rose 13.1 percent to $377,631 while the median price increased 14.7 percent to $305,000. Both figures are record highs for an October.

The time it took to sell a home fell by about two weeks compared to October 2020. Days on Market (DOM) went from 48 to 32. Inventory registered a 1.8-months supply compared to 2.3 months a year earlier. That level is the highest of 2021 but stands below the current national inventory of 2.4 months recently reported by NAR.

Broken out by housing segment, October sales performed as follows:

- $1 - $99,999: decreased 20.8 percent

- $100,000 - $149,999: decreased 42.3 percent

- $150,000 - $249,999: decreased 39.1 percent

- $250,000 - $499,999: increased 17.5 percent

- $500,000 - $999,999: increased 23.1 percent

- $1M and above: increased 20.4 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 7,361 in September. That was statistically unchanged from the same month last year. The average sales price rose 13.2 percent to $374,317 while the median sales price climbed 15.4 percent to $299,000.

For HAR’s Monthly Activity Snapshot (MAS) of the October 2021 trends, please click HERE to access a downloadable PDF file.

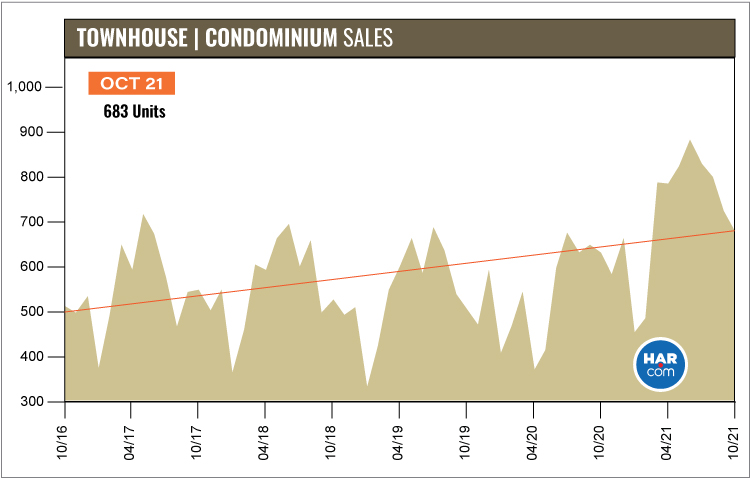

Townhouse/Condominium Update

Sales of townhouses and condominiums increased for the 14th consecutive month in October, rising 7.6 percent with 683 closed sales versus 635 a year earlier. The average price rose 12.6 percent to $247,846 and the median price shot up 23.0 percent to $219,000. Inventory fell from a 3.9-months supply to 2.3 months.

Houston Real Estate Highlights in October

- Single-family home sales fell for the second time in 2021, down 5.2 percent with 8,703 units sold versus 9,183 in October 2020;

- The Days on Market (DOM) figure for single-family homes rolled back from 48 to 32;

- Total property sales fell 3.1 percent with 10,756 units sold;

- Total dollar volume rose 9.9 percent to $3.8 billion;

- The single-family average price increased 13.1 percent to $377,631;

- The single-family median price rose 14.7 percent to $305,000;

- Single-family homes months of inventory registered a 1.8-months supply, down from 2.3 months year-over-year and below the national inventory of 2.4 months;

- On a year-to-date basis, single-family homes sales are running 12.9 percent ahead of 2020’s record pace and 21.6 percent ahead of 2019.

- Townhome/condominium sales rose 7.6 percent with the average price up 12.6 percent to $247,846 and the median price up 23.0 percent to $219,000;

- Single-family home rentals fell 3.4 percent with the average rent up 9.7 percent to $2,092;

- Townhome/condominium leases fell 1.3 percent with the average rent up 7.3 percent to $1,712.