Thirty-six percent of Texas households could afford to buy a median-priced home in Q3 2023

HOUSTON — (November 9, 2023) — Rising interest rates continued to put a strain on housing affordability in the Greater Houston area and across the state of Texas in the third quarter of 2023, according to new data from the Houston Association of Realtors (HAR).

HAR’s Housing Affordability Index (HAI) finds that 35 percent of Houston-area households could afford to purchase a median-priced home in the metro area in the third quarter of this year due largely to mortgage rates which recently hit a 20-year high. This is the lowest that housing affordability has been in the Houston metro area since at least 2012, which is as far back as the income data is available. Despite easing home prices, housing affordability in the Houston area was down from 39 percent in the second quarter of 2023 and down from 41 percent in the third quarter of 2022.

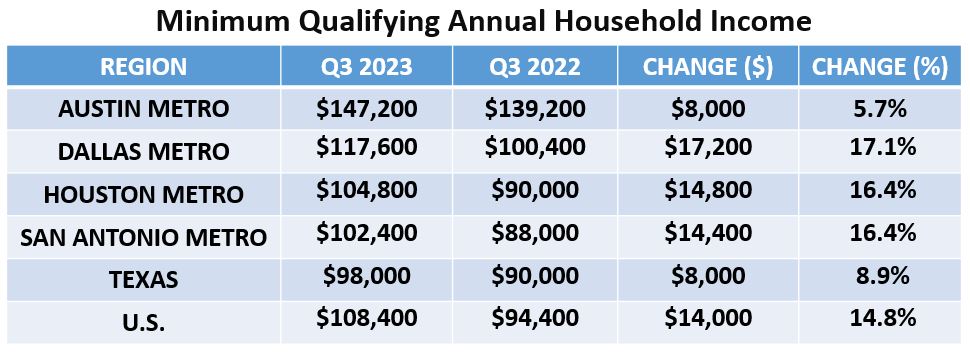

The median home price in the Houston area declined 1.1 percent to $345,600 in the third quarter of this year. The monthly mortgage payment on a 30-year, fixed-rate loan, including taxes and insurance, rose to $2,620 from $2,250 a year ago. The average interest rate rose to 7.04 percent in the third quarter of 2023 compared to 5.62 percent last year. A minimum annual income of $104,800 was needed to qualify for the purchase of the median-priced home, which is 16.4 percent more income needed annually compared to a year ago.

Thirty-six percent of households across Texas could afford to buy a median-priced home in the third quarter of 2023. According to HAR's HAI, this is the lowest that housing affordability has been in the Lone Star State since at least 2012, which is as far back as the income data is available. Statewide affordability is down from 39 percent in the third quarter of 2022. An annual household income of $98,000 was needed to qualify for the purchase of a $345,000 median-priced home statewide.

Compared with Texas, 33 percent of the nation’s households could afford the $406,900 median-priced home, which required a minimum annual income of $108,400 to make monthly payments of $2,710. Nationwide affordability was down from 38 percent at this time last year.

The chart below shows how the minimum annual household income needed to purchase a home has changed year-over-year.

For a pre-pandemic perspective, home prices in the Houston area are up 38.9 percent compared to 2019 when the median home price was $248,900. Fifty-nine percent of Houston-area households could afford to buy a home in the third quarter of 2019 compared to 35 percent in the third quarter of 2023.

“Although home prices continue to moderate, I believe the higher mortgage rates are keeping many prospective homebuyers on the sidelines,” said HAR Chair Cathy Treviño with LPT, Realty. “Homebuyers who are in the market will notice Houston's housing inventory remains robust, due in part to the current mortgage rates. We are also continuing to see strong demand in the rental market as consumers keep a close eye on economic conditions nationwide.”

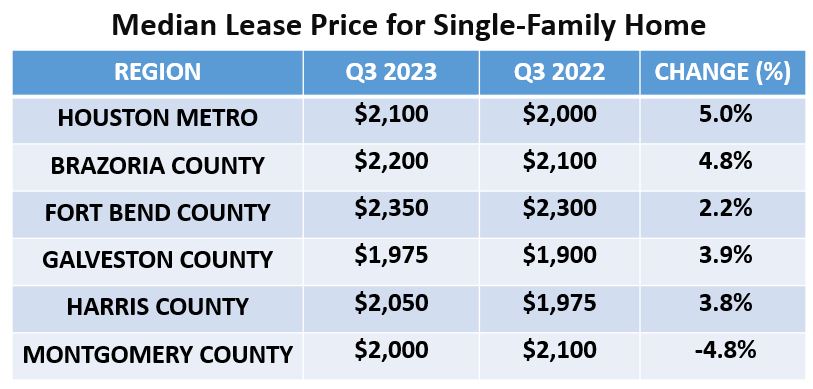

Lease prices for a single-family home increased in most of the Houston metro area in the third quarter of this year, according to HAR’s Rental Affordability Index, which measures the percentage of households that can afford to pay the median monthly rent for a single-family home in the Greater Houston area. The median lease price rose 5.0 percent to $2,100 in the third quarter of 2023 in the Houston area.

Rental affordability was down from 46 percent in the third quarter of last year to 45 percent this year. Households in the Houston area needed to make a minimum annual income of $84,000 to afford the median lease payment on a home. This does not include the security deposit or cost of utilities.

Highlights from the Q3 2023 Housing Affordability Report:

• Compared to the previous year, housing affordability declined in 13 tracked counties (Austin, Brazoria, Chambers, Fort Bend, Galveston, Grimes, Harris, Matagorda, Montgomery, Polk, San Jacinto, Walker and Waller). Affordability increased in two counties (Liberty and Wharton).

• The most affordable counties were Wharton County (51 percent) and Chambers County (49 percent).

• In Harris County, Baytown was the most affordable community. Forty-five percent of Harris County households made the minimum annual income of $74,800 to afford a median-priced home in Baytown. Memorial Villages and the River Oaks Area were the least affordable with only three percent of households in Harris County able to afford to purchase the median-priced home in these communities.

• In Fort Bend County, Stafford was the most affordable area—59 percent of Fort Bend County households were able to afford the median-priced home in Stafford based on the minimum annual income of $85,200. Fulshear was the least affordable (17 percent).

• In Montgomery County, Conroe was the most affordable area—51 percent of households in the county were able to afford the median-priced home in those areas based on the annual income. The Woodlands was the least affordable (25 percent) with households needing a minimum annual income of $174,400.

• In Brazoria County, Angleton was the most affordable—54 percent of Brazoria County households were able to afford the median-priced home in Angleton based on the annual income. Manvel was the least affordable (19 percent).

• In Galveston County, La Marque was the most affordable—47 percent of Galveston County households were able to afford the median-priced home in La Marque based on the annual income. Friendswood was the least affordable (17 percent).

Highlights from the Q3 2023 Rental Affordability Report:

• Compared to the previous year, Montgomery County was the only tracked county that saw an increase in rental affordability. Affordability declined in five counties (Chambers, Galveston, Harris, Walker and Waller) and was unchanged in three counties (Brazoria, Fort Bend and Liberty).

• Lease prices were most affordable for households in Montgomery County. Based on the median annual income, 57 percent of households in Montgomery County could afford the median monthly rent of $2,000 for a single-family home.

For HAR’s full Housing and Rental Affordability Reports and data tables, click

HERE.