Monthly Housing Update

A comprehensive overview of monthly property sales activity for the Greater Houston area as recorded in the MLS.

Multiple Listing Service of the Houston Association of REALTORS® includes residential properties and new homes listed by 50,000 REALTORS®

HOUSTON REAL ESTATE REMAINS INSULATED FROM FEBRUARY’S ARCTIC BLAST

Despite the freak winter storm, sales climbed for a ninth straight month and pricing set a new record

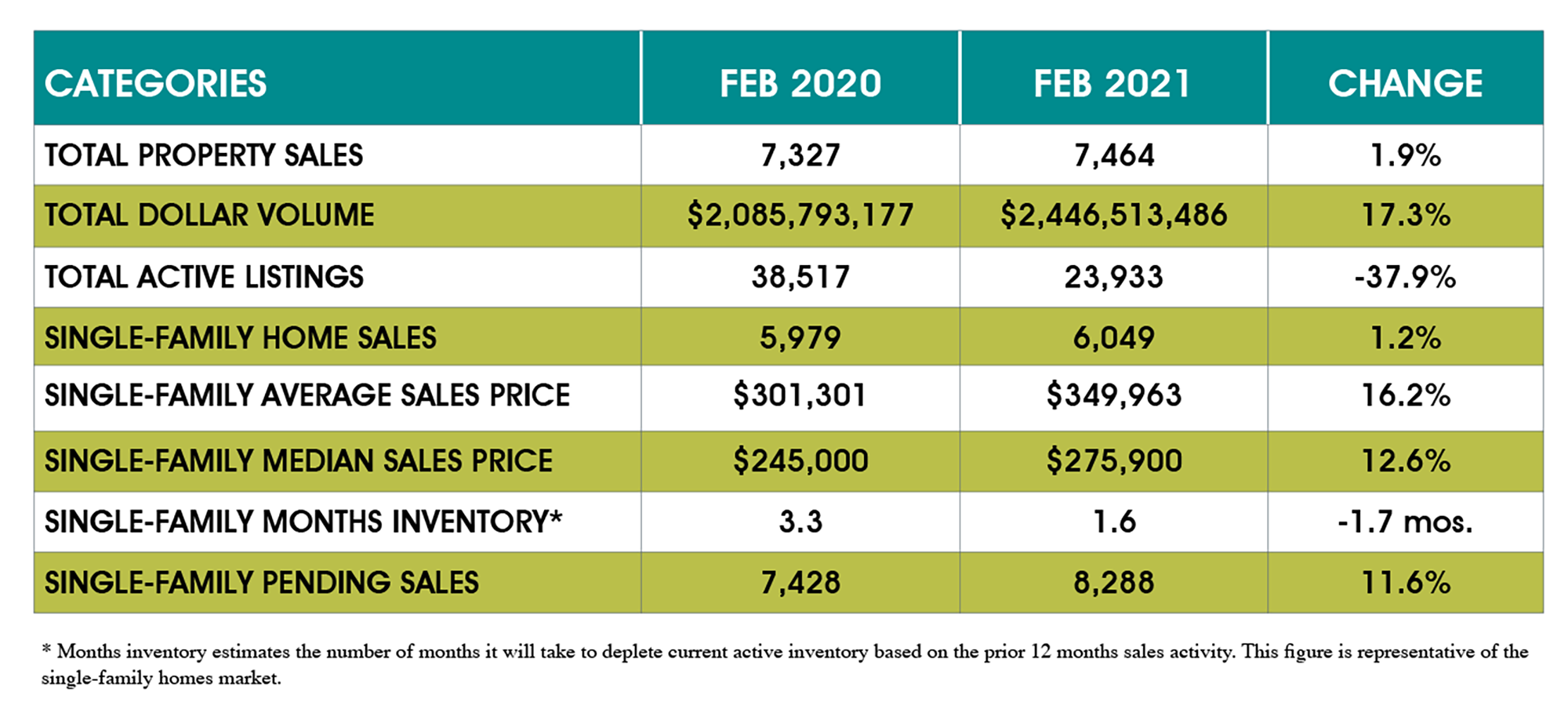

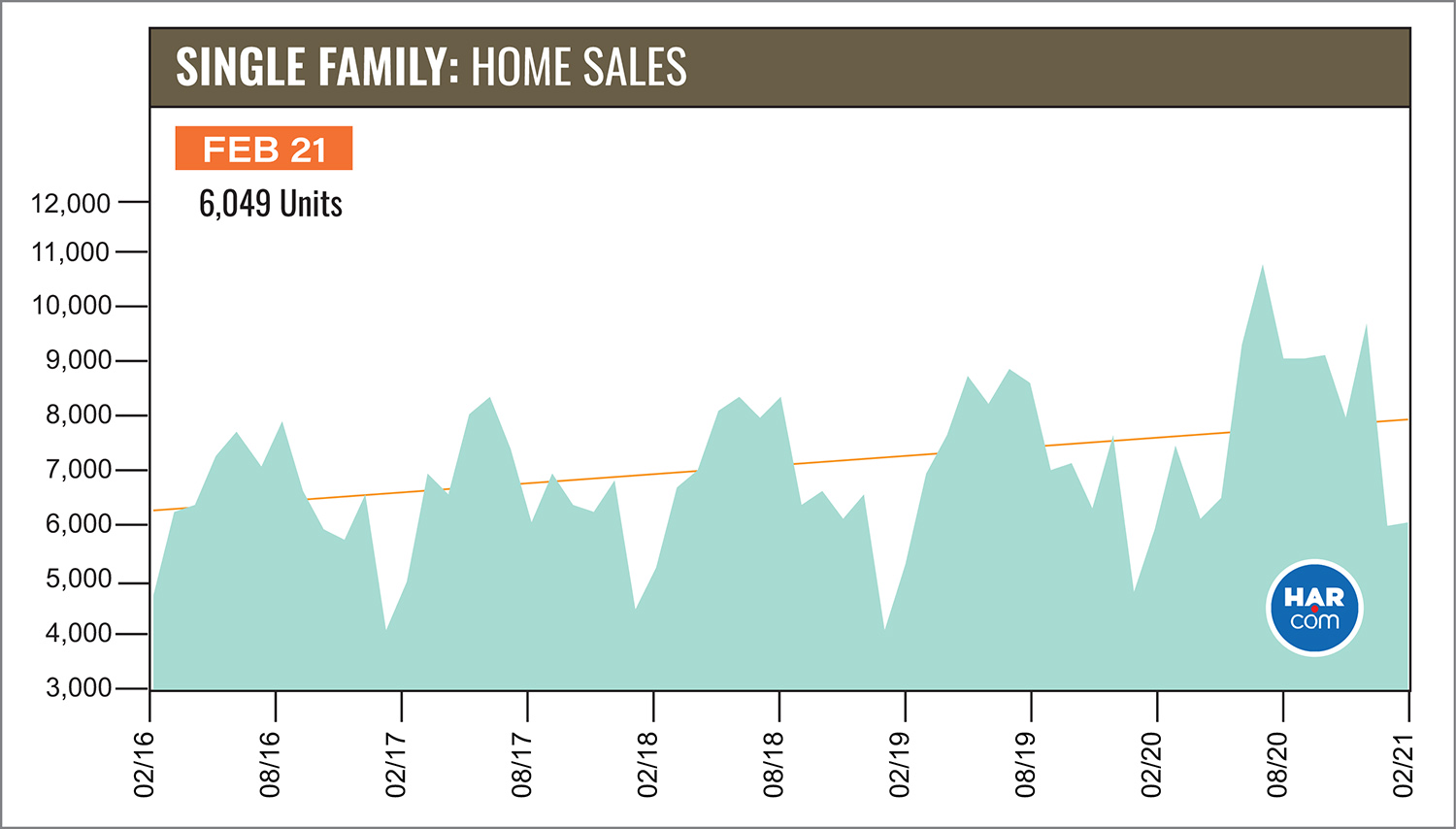

HOUSTON — (March 10, 2021) — The deadly and disruptive winter storm that left many Houston-area homes without power and water even after mild temperatures returned did little to chill local real estate in February. While the freak weather event delayed some closings due to plumbing-related repairs and property damage, sales of single-family homes rose for a ninth straight month. The increase was also achieved despite an ever-shrinking supply of homes and the first uptick in mortgage rates since last summer – all with the backdrop of the coronavirus pandemic.

According to the latest Houston Association of Realtors (HAR) Market Update, 6,049 single-family homes sold in February compared to 5,979 a year earlier. That translates to a 1.2 percent increase. Once again, luxury housing was the top-performing segment among homebuyers.

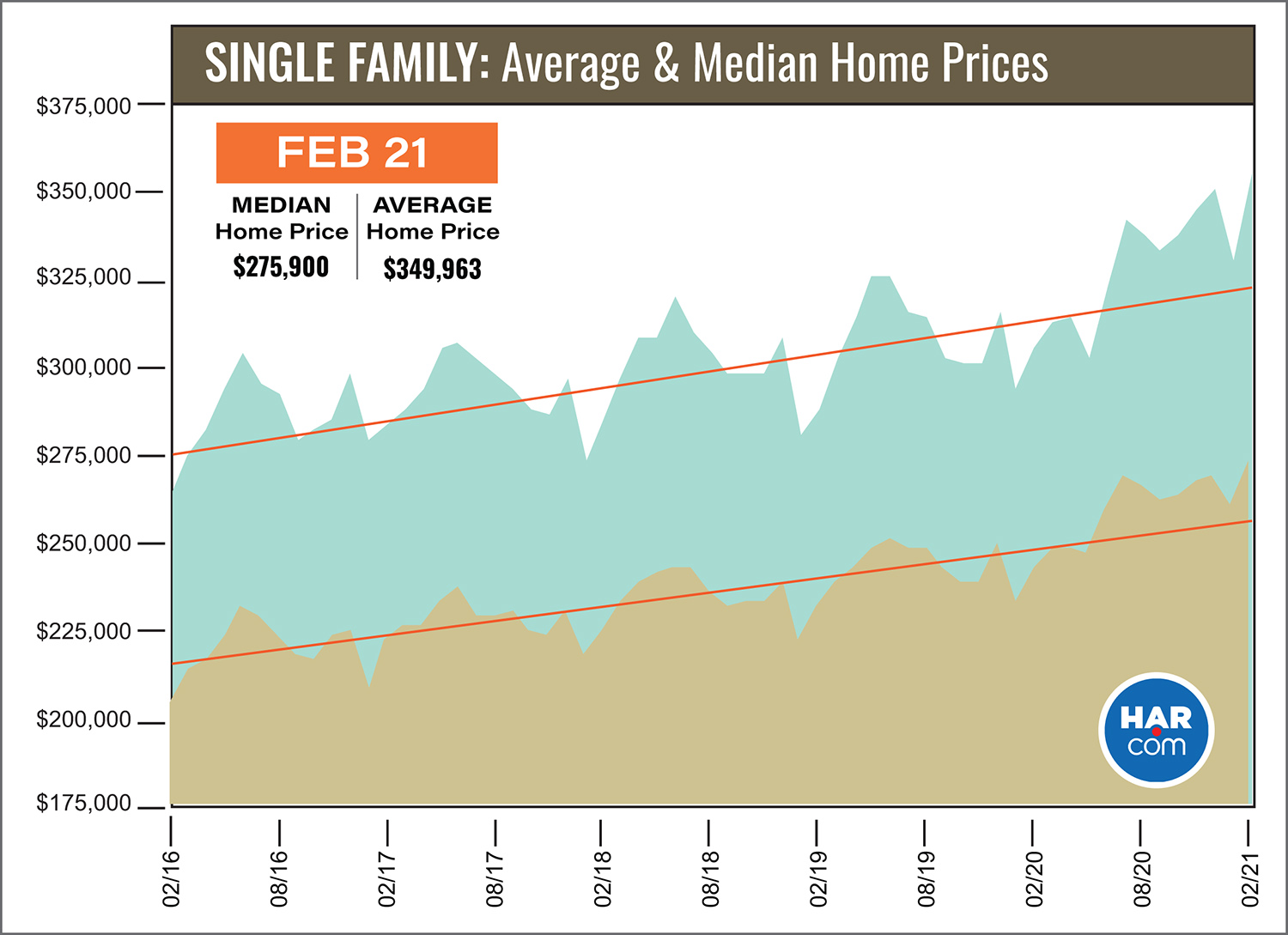

Homes priced at $750,000 and above surged 64.9 percent compared versus February 2020. That was followed by the $500,000 to $750,000 housing segment, which jumped 55.3 percent year-over-year. Pricing reached historic highs, with the single-family home average price rising 16.2 percent to $349,963 and the median price increasing 12.6 percent to $275,900.

Sales of all property types totaled 7,464 – up 1.9 percent from February 2020. Total dollar volume for the month rose 17.3 percent to $2.4 billion.

“The Houston housing market showed resiliency again last month, coming through strong despite the brutal winter storm that caused widespread power outages, property damage and briefly held up transactions and showings,” said HAR Chairman Richard Miranda with Keller Williams Platinum. “As we head into spring, we urgently need more listings to enter the marketplace or we risk having extremely limited inventory for consumers that want to buy a home now, especially with the prospect of rising mortgage interest rates.”

The 30-year fixed-rate mortgage rose above 3 percent for the first time in seven months last week. According to Freddie Mac, the 30-year fixed-rate average climbed to 3.02 percent. It was 2.97 percent a week earlier and 3.29 percent a year earlier. The last time it was above 3 percent was in July of 2020.

Lease Property Update

Consumers showed more interest in homes for sale than in lease properties in February. Leases of single-family homes fell 26.1 percent year-over-year while leases of townhomes and condominiums dropped 15.7 percent. The average rent for single-family homes increased 8.7 percent to $1,924 while the average rent for townhomes and condominiums increased 1.9 percent to $1,637.

February Monthly Market Comparison

The Houston real estate market powered its way through a ninth consecutive month of sales gains in February, defying a destructive and disruptive winter storm, scant inventory and the ongoing coronavirus pandemic.

The monthly sales readings were positive across the board. Single-family home sales, total property sales and total dollar volume all rose compared to February 2020. Pending sales climbed 11.6 percent. However, total active listings – or the total number of available properties – fell 37.9 percent as fewer new listings entered the market.

A 27.8 percent year-over-year decline in new listings combined with another positive month of sales drove single-family homes inventory down to a 1.6-months supply compared to 3.3 months a year earlier. That is the lowest inventory level of all time. Housing inventory nationally also stands at an historic low – a 1.9-months supply, according to the National Association of Realtors (NAR).

Single-Family Homes Update

Single-family home sales rose 1.2 percent in February with 6,049 units sold across the greater Houston area compared to 5,979 a year earlier. Strong sales volume among homes at the high end of the market pushed pricing to record highs. The single-family home average price climbed 16.2 percent to $349,963 while the median price rose 12.6 percent to $275,900.

It took less time to sell a home than it did one year ago. Days on Market (DOM) fell from 68 to 48. With fewer new listings entering the market, inventory registered a record low 1.6-months supply compared to 3.3 months a year earlier. That figure is slightly below the current national inventory level of 1.9 months recently reported by NAR.

Broken out by housing segment, February sales performed as follows:

- $1 - $99,999: decreased 40.6 percent

- $100,000 - $149,999: decreased 42.8 percent

- $150,000 - $249,999: decreased 16.8 percent

- $250,000 - $499,999: increased 16.0 percent

- $500,000 - $749,999: increased 55.3 percent

- $750,000 and above: increased 64.9 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 4,786 in February, up 3.0 percent compared to the same month last year. The average sales price jumped 21.6 percent to $348,703 while the median sales price climbed 17.4 percent to $270,000.

For HAR’s Monthly Activity Snapshot (MAS) of the February 2021 trends, please CLICK HERE to access a downloadable PDF file.

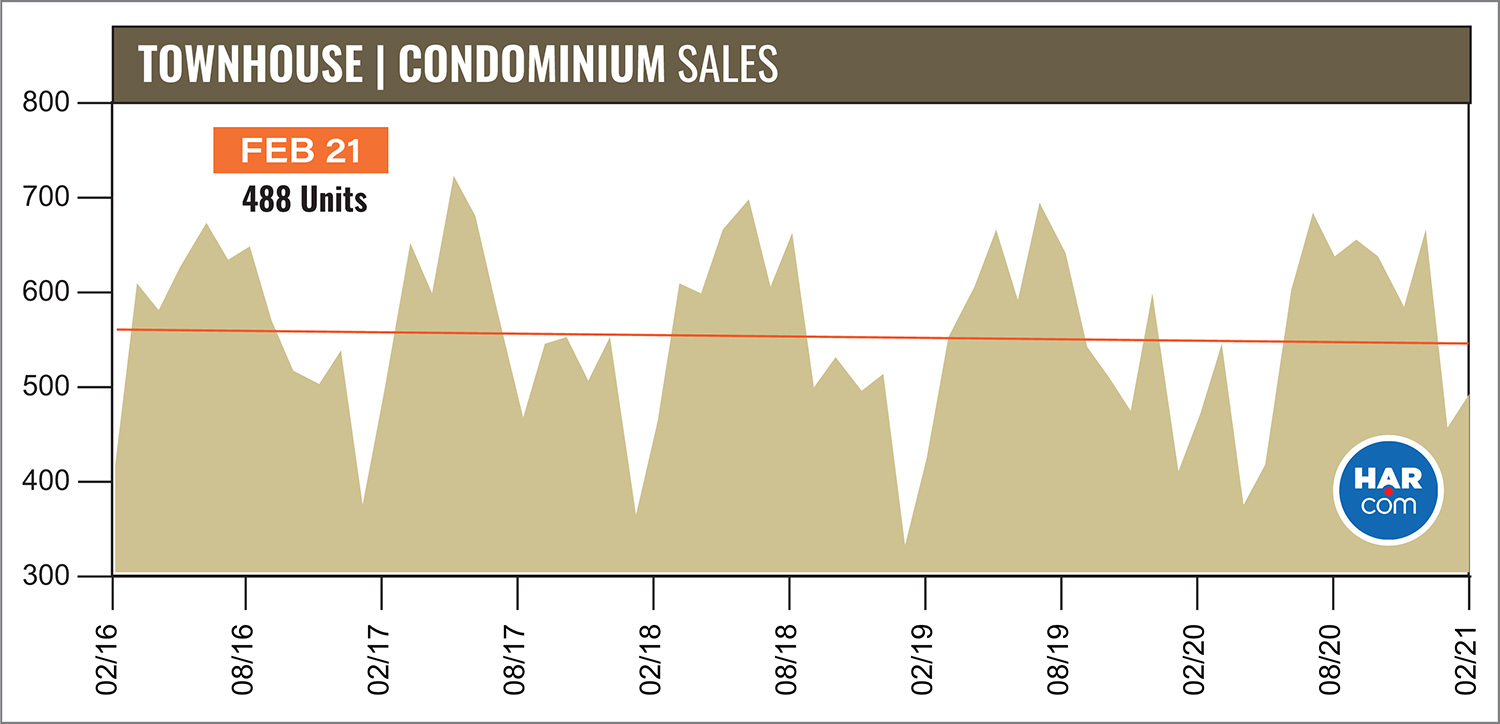

Townhouse/Condominium Update

Sales of townhouses and condominiums increased for the sixth straight month in February, rising 4.1 percent with 488 closed sales versus 469 a year earlier. The average price increased 1.4 percent to $219,326 and the median price edged up 1.0 percent to $178,700. Inventory fell from a 3.9-months supply to 3.2 months.

Houston Real Estate Highlights in February

- Single-family home sales increased for the ninth consecutive month, up 1.2 percent year-over-year with 6,049 units sold;

- The Days on Market (DOM) figure for single-family homes dropped from 68 to 48;

- Total property sales rose 1.9 percent with 7,464 units sold;

- Total dollar volume jumped 17.3 percent to $2.4 billion;

- The single-family average price reached a record high, rising 16.2 percent to $349,963;

- The single-family median price climbed 12.6 percent to $275,900 – also a record high;

- Single-family homes months of inventory registered an historic low 1.6-months supply, down from 3.3 months before the pandemic and below the national inventory of 1.9 months;

- Townhome/condominium sales rose 4.1 percent with the average price up 1.4 percent to $219,326 and the median price up 1.0 percent to $178,700;

- Single-family home rentals fell 26.1 percent with the average rent up 8.7 percent to $1,924;

- Townhome/condominium leases dropped 15.7 percent with the average rent up 1.9 percent to $1,637.