Monthly Housing Update

Multiple Listing Service of the Houston Association of REALTORS® includes residential properties and new homes listed by 50,000 REALTORS®

THE HOUSTON HOUSING MARKET COOLS IN SEPTEMBER

Home sales and leases take a post-summer breather, but continue to outpace 2017’s record volume

HOUSTON — (October 10, 2018) — After a sizzling summer of home sales and rentals, the Houston housing market cooled in September, showing no apparent lingering effects of Hurricane Harvey as it did in August.

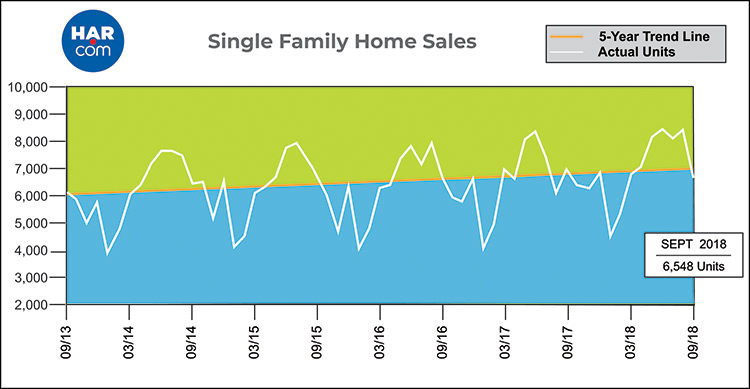

According to the latest monthly report from the Houston Association of REALTORS® (HAR), 6,548 single-family homes sold in September compared to 6,953 a year earlier. That represents a 5.8-percent decline. On a year-to-date basis, however, home sales are running 5.6 percent ahead of 2017’s record volume.

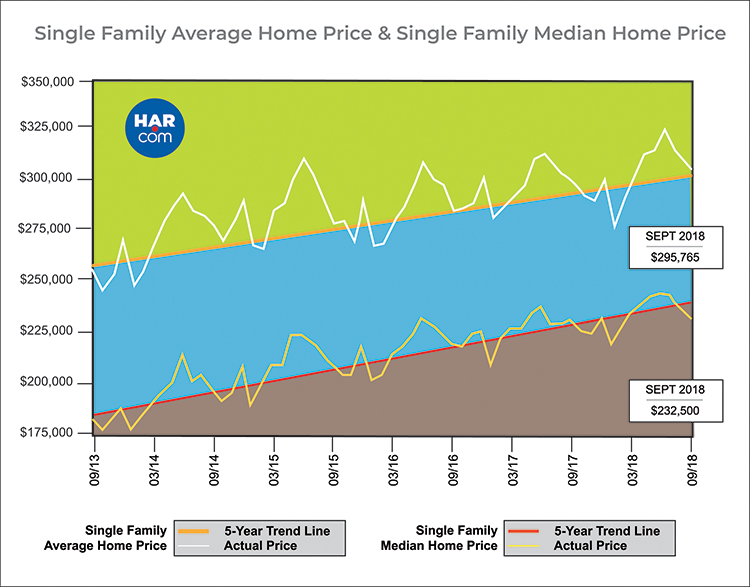

The single-family home median price (the figure at which half of the homes sold for more and half for less) eked out a fractional 0.2 percent increase to $232,500, and the average price edged up 1.2 percent to $295,765. Both represent the highest prices ever for a September. All housing segments experienced declines except those homes priced at $750,000 and above – considered the luxury market – which rose 2.7 percent.

September sales of all property types totaled 7,842, a 4.4-percent decrease over the same month last year. Total dollar volume was down 3.5 percent at $2.2 billion.

“With tight inventory, rising interest rates and families focused on back-to-school, it wasn’t a huge surprise to see market activity slow down at this time,” said HAR Chair Kenya Burrell-VanWormer with JPMorgan Chase. “The Houston economy is strong. As we head into the fall months, it will definitely take a healthy supply of homes and some pricing moderation to keep prospective buyers engaged in the market.”

The employment landscape across Houston remains robust and has served as a solid driver for real estate throughout 2018. In the October 2018 edition of The Economy at a Glance, the Greater Houston Partnership (GHP) reported that metro Houston created 110,200 jobs in the 12 months ending August 2018. That is a 3.7 percent increase and the strongest 12-month pace in more than three years.

Lease Property Update

Activity among lease properties was down sharply in September. Single-family home rentals fell 35.4 percent while leases of townhomes and condominiums dropped 44.5 percent. With the decline in volume came a decline in rents. The average rent for single-family homes slid 4.0 percent to $1,812 while the average rent for townhomes and condominiums dipped 1.0 percent to $1,584.

September Monthly Market Comparison

Measurements of the Houston real estate market’s September trends were mixed, with single-family home sales, total property sales and total dollar volume all down compared to September 2017, and pricing up slightly. Month-end pending sales for single-family homes totaled 6,630, a 9.0 percent increase over last year. Total active listings, or the total number of available properties, climbed 5.7 percent to 41,560.

Single-family homes inventory remains constrained, reaching a 4.0-months supply in September versus the 3.9-months supply a year earlier. For perspective, housing inventory across the U.S. stands at a 4.3-months supply, according to the latest report from the National Association of REALTORS® (NAR).

Single-Family Homes Update

Sales of single-family homes fell 5.8 percent in September, with 6,548 units sold across the greater Houston area compared to 6,953 a year earlier. However, on a year-to-date basis, home sales are 5.6 percent ahead of 2017’s record pace.

Prices reached the highest levels ever for a September. The median price increased a fractional 0.2 percent to $232,500. The average price rose 1.7 percent to $295,765.

The Days on Market (DOM) figure, or the number of days it took the average home to sell, was 52 compared to 54 a year earlier. Inventory registered a 4.0-months supply, up ever so slightly from 3.9 months a year ago.

Broken out by housing segment, September sales performed as follows:

- $1 - $99,999: decreased 12.4 percent

- $100,000 - $149,999: decreased 15.4 percent

- $150,000 - $249,999: decreased 2.0 percent

- $250,000 - $499,999: decreased 6.2 percent

- $500,000 - $749,999: decreased 3.2 percent

- $750,000 and above: increased 2.7 percent

HAR also breaks out sales data for existing single-family homes. Existing home sales totaled 5,485 in September, a decline of 4.6 percent versus the same month last year. The average sales price fell 0.5 percent to $279,043 while the median sales price rose 0.5 percent to $219,900.

Townhouse/Condominium Update

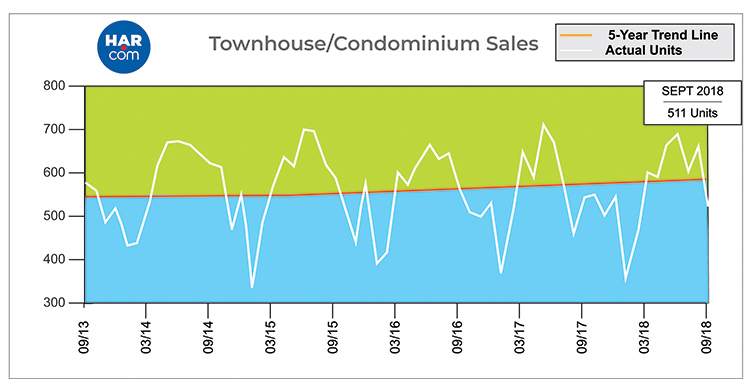

Townhomes and condominiums also experienced a sluggish month in September, as sales slid 6.1 percent with 511 units sold versus 544 a year earlier. The average price tumbled 6.6 percent to $191,967 and the median price was flat at $159,450. Inventory rose from a 3.9-months supply to 4.4 months.

Houston Real Estate Highlights in September

- Single-family home sales fell 5.8 percent year-over-year, with 6,548 units sold;

- Days on Market (DOM) for single-family homes was 52 days;

- Total property sales declined 4.4 percent, with 7,842 units sold;

- Total dollar volume was down 3.5 percent to $2.2 billion;

- The single-family home median price edged up 0.2 percent to $232,500, a September high;

- The single-family home average price also achieved a September record, rising 1.7 percent to $295,765;

- Single-family homes months of inventory was at a 4.0-months supply, up fractionally from 3.9 months last September and slightly below the national supply of 4.3 months reported by NAR;

- Townhome/condominium sales fell 6.1 percent, with the average price down 6.6 percent to $191,967 and the median price unchanged at $159,450;

- Leases of single-family homes dropped 35.4 percent with the average rent down 4.0 percent to $1,812;

- Volume of townhome/condominium leases plunged 44.5 percent with the average rent down 1.0 percent to $1,584.