Monthly Housing Update

A comprehensive overview of monthly property sales activity for the Greater Houston area as recorded in the MLS.

Multiple Listing Service of the Houston Association of REALTORS® includes residential properties and new homes listed by 50,000 REALTORS®

HOUSTON HOUSING PLOWS THROUGH THE SECOND YEAR OF A PANDEMIC TO ACHIEVE NEW SALES RECORDS

Despite the ongoing health crisis, historically low inventory and rising home prices, consumer demand for housing kept the Houston market buzzing

HOUSTON — (January 12, 2022) — The second year of a global pandemic, dwindling inventory, building supply and labor shortages that slowed home construction, and rising home prices could not prevent the Houston real estate market from turning 2021 into a record year. Consumers never eased up on their demand to buy or rent homes and paid more for them as the supply of housing grew smaller. Single-family home sales surpassed 2020’s record volume by more than 10 percent, and total dollar volume soared nearly 32 percent to a record $47 billion.

The key to Houston’s pandemic-resistant housing market dates back to the spring of 2020, when Houston Association of REALTORS (HAR) leadership convinced local elected officials to designate real estate an essential service. The move enabled Realtors to resume working with would-be homebuyers looking to take advantage of historically low mortgage interest rates as stay-at-home orders began to be lifted. REALTORS also assisted consumers seeking rental properties while waiting for more for-sale homes to be listed. Virtual technology developed by HAR made it possible for consumers to attend open houses and property showings remotely, without putting their health at risk, and remains in steady use even when pandemic conditions have improved.

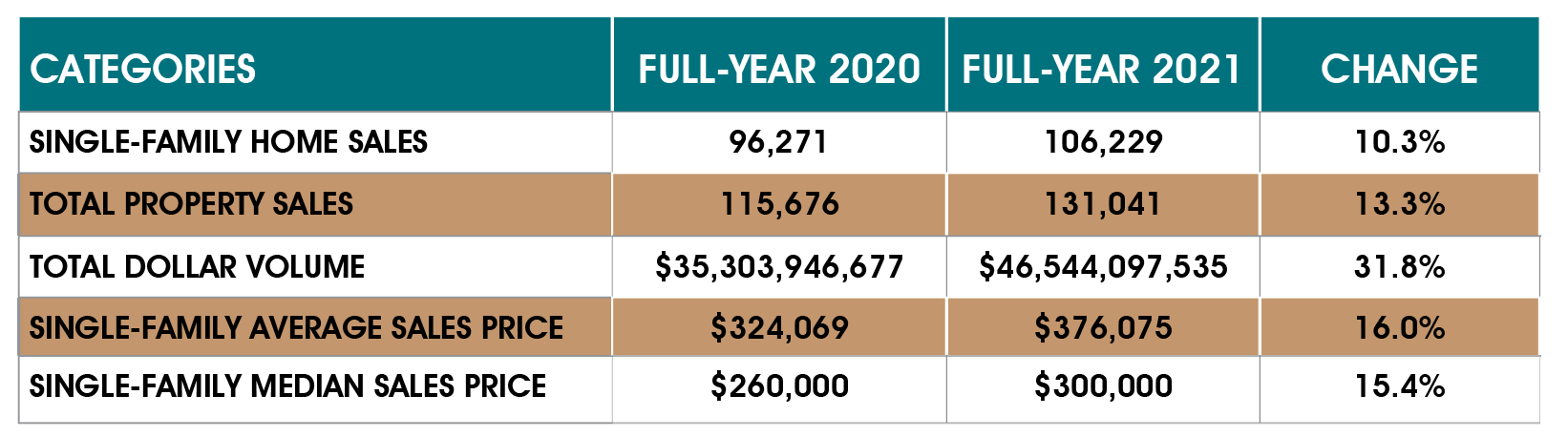

According to HAR’s December/Full-Year 2021 Housing Market Update, single-family home sales for 2021 rose 10.3 percent to 106,229. Sales of all property types for the year totaled 131,041, up 13.3-percent from 2020’s record volume and only the third time in history that total property sales surpassed the 100,000 level. Total dollar volume for 2021 shot up 31.8 percent to a record-breaking $47 billion.

“It was impossible to know what 2021 would have in store for Houston real estate, especially as the surges in coronavirus variants began affecting our area, but the need for housing never abated and REALTORS delivered,” said HAR Chair Jennifer Wauhob with Better Homes and Gardens Real Estate Gary Greene. “Limited inventory and shortages of building supplies and labor on the new construction side also posed serious challenges, but the market powered through it all to achieve a record year. As we enter 2022, inventory and affordability are definite concerns.”

Single-family home sales experienced their third decline of 2021 in December, falling 4.5 percent versus December 2020. However, that was not enough to prevent the market from hitting record-breaking territory. The strongest monthly sales volume registered was among homes priced between $500,000 and $999,999, which jumped 41.4 percent year-over-year. Homes in the $250,000 to $499,999 range came in second place with a 17.0 percent increase The luxury market, consisting of homes priced at $1 million and up, ranked third in sales activity, climbing 8.8 percent.

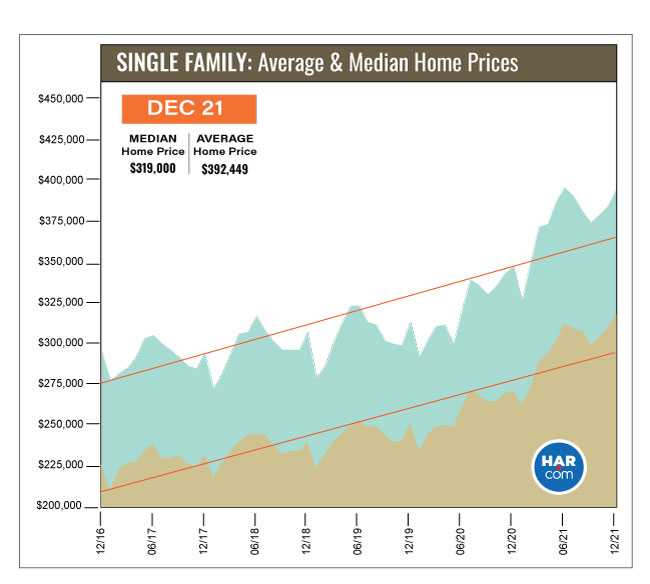

The median price of a single-family home – the figure at which half of the homes sold for more and half sold for less – established a new historic high of $319,000 in December. The average price reached the second highest level of all time – $392,449.

2021 Annual Market Comparison

Achieving a record year in 2020, despite the many obstacles created by the coronavirus pandemic, offered no assurances that conditions would remain favorable for real estate in 2021. But the market carried the positive momentum forward into the new year with inventory peaking at a 1.8-months supply in August amid a backdrop of continued strong sales and dwindling new listings. Supply gradually began to taper each month after, ending the year at a 1.4-months supply – the second lowest of 2021. Consumers interested in new homes faced their own challenges in 2021 as supply chain interruptions and a shortage of construction laborers resulted in some home building delays.

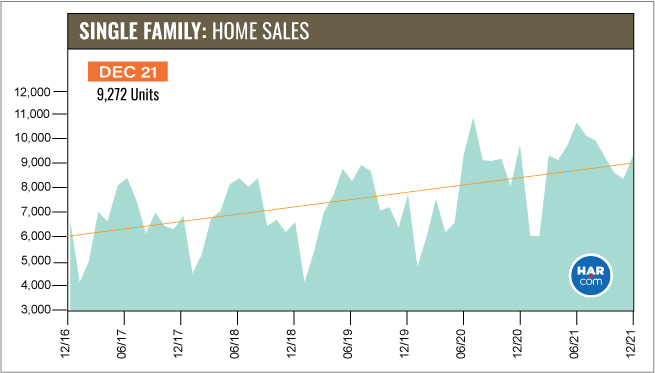

June was the strongest month of the year for sales with 10,642 single-family units sold – the second greatest volume of all time. That same month, the market set a new record average price of $393,263. The greatest sales volume decline (6.7 percent) of 2021 occurred in July, but it was a bit of an anomaly. Sales were actually strong, but could not rival the surge in closings taking place that same month in 2020 as transactions that were stalled due to COVID-related lockdowns finally pushed through. October and December were also negative months for sales.

By the time the books were closed on December transactions, a record 106,229 single-family homes had sold across greater Houston in 2021. That represents an increase of 10.3 percent from the previous record of 96,271 in 2020.

On a year-to-date basis, the average price rose 16.0 percent to $376,075 while the median price increased 15.4 percent to $300,000 – both records. Total dollar volume for full-year 2021 jumped 31.8 percent to a record-setting $47 billion.

Houston’s lease market had a generally strong 2021 as prospective buyers secured homes to rent until they are ready to resume the buying process. The rent for a single-family home reached a record high of $2,162 in July while the rent for townhomes and condominiums reached an all-time high of $1,801 in June.

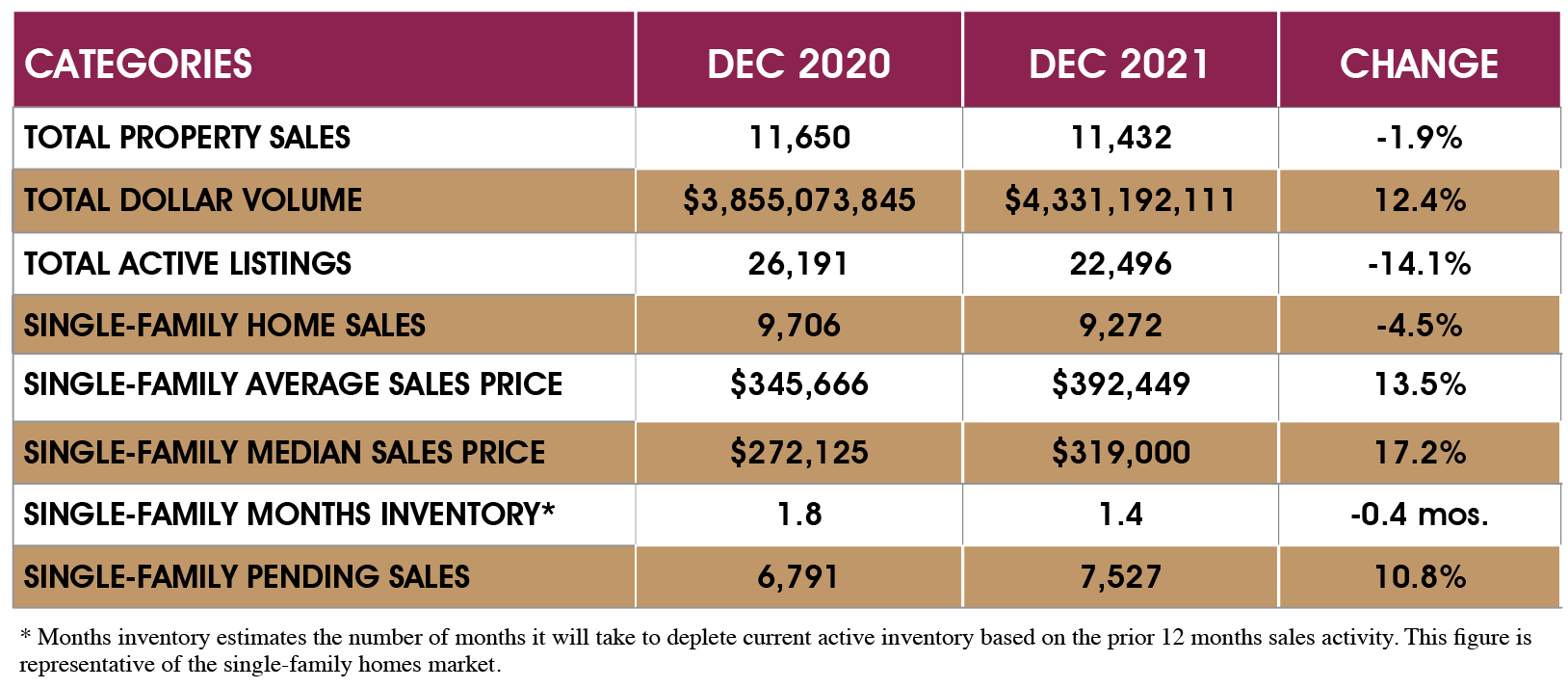

December Monthly Market Comparison

The Houston housing market generated mixed results in December. Single-family home sales and total property sales declined compared to December 2020 while total dollar volume and pricing rose. Month-end pending sales for single-family homes totaled 7,527, an increase of 10.8 percent versus one year earlier. Total active listings, or the total number of available properties, fell 14.1 percent from a year earlier to 22,496.

Single-family homes inventory narrowed from a 1.8-months supply to 1.4 months. For perspective, housing inventory across the U.S. currently stands at a 2.1-months supply, according to the latest National Association of Realtors (NAR) report.

For HAR’s Monthly Activity Snapshot (MAS) of the December 2021 trends, please CLICK HERE to access a downloadable PDF file.

December Single-Family Homes Update

Single-family home sales totaled 9,272, down 4.5 percent from December 2020. That marked the third negative sales month of 2021, with declines also recorded in July and October. The median price rose 17.2 percent to an all-time high of $319,000. The average price increased 13.5 percent to $392,449 – the second highest average price in history. Days on Market (DOM), or the number of days it took the average home to sell, dropped from 47 to 37.

Broken out by housing segment, December sales performed as follows:

- $1 - $99,999: decreased 45.3 percent

- $100,000 - $149,999: decreased 41.5 percent

- $150,000 - $249,999: decreased 39.2 percent

- $250,000 - $499,999: increased 17.0 percent

- $500,000 - $999,999: increased 41.4 percent

- $1M and above: increased 8.8 percent

HAR also breaks out the sales figures for existing single-family homes. Existing home sales totaled 7,358 in December. That is up 2.7 percent versus the same month last year. The average sales price increased 14.9 percent to $389,456 while the median sales price jumped 17.0 percent to $310,000.

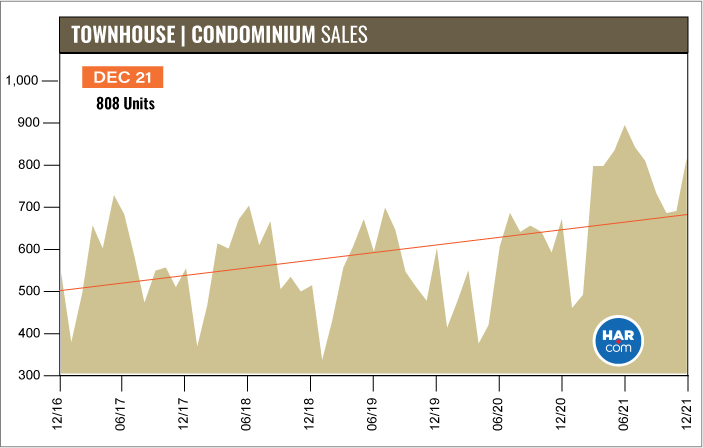

Townhouse/Condominium Update

Townhome and condominium sales sailed through 2021 with a perfect record – not a single month of declining sales. December volume jumped 21.5 percent with 808 units sold versus 665 a year earlier. The average price climbed 13.8 percent to $258,139 while the median price soared 20.9 percent to $220,000. Inventory dwindled from a 3.3-months supply to 1.7 months.

Lease Property Update

Houston’s lease market staged a mixed performance in December. Single-family home leases rose 5.9 percent while townhome/condominium leases fell 23.0 percent. The average rent for single-family homes was up 7.5 percent to $2,042 while the average rent for townhomes/condominiums increased 5.5 percent to $1,731.

Houston Real Estate Highlights for December and Full-Year 2021

- Despite the ongoing coronavirus pandemic, 2021 proved to be a record year for Houston real estate with 106,229 single-family homes sold versus 96,271 in 2020, the last record-setting year. That represents an increase of 10.3 percent;

- Total dollar volume for full-year 2021 rose 31.8 percent to a record-setting $47 billion;

- December single-family home sales declined 4.5 percent year-over-year with 9,272 units sold;

- Total December property sales fell 1.9 percent to 11,432 units;

- Total dollar volume for December rose 12.4 percent to $4.3 billion;

- At $319,000, the single-family home median price rose 17.2 percent to an all-time high;

- The single-family home average price climbed 13.5 percent to the second highest in history, $392,449;

- Single-family homes months of inventory narrowed to a 1.4-months supply;

- Townhome/condominium sales ended a strong year with a 21.5 percent year-over-year jump in volume, the average price up 13.8 percent to $258,139 and the median price up 20.9 percent to $220,000;

- Leases of single-family homes rose 5.9 percent with average rent up 7.5 percent to $2,042;

- Leases of townhomes/condominiums fell 23.0 percent with average rent up 5.5 percent to $1,731.