Financing Contingency: A Comprehensive Guide

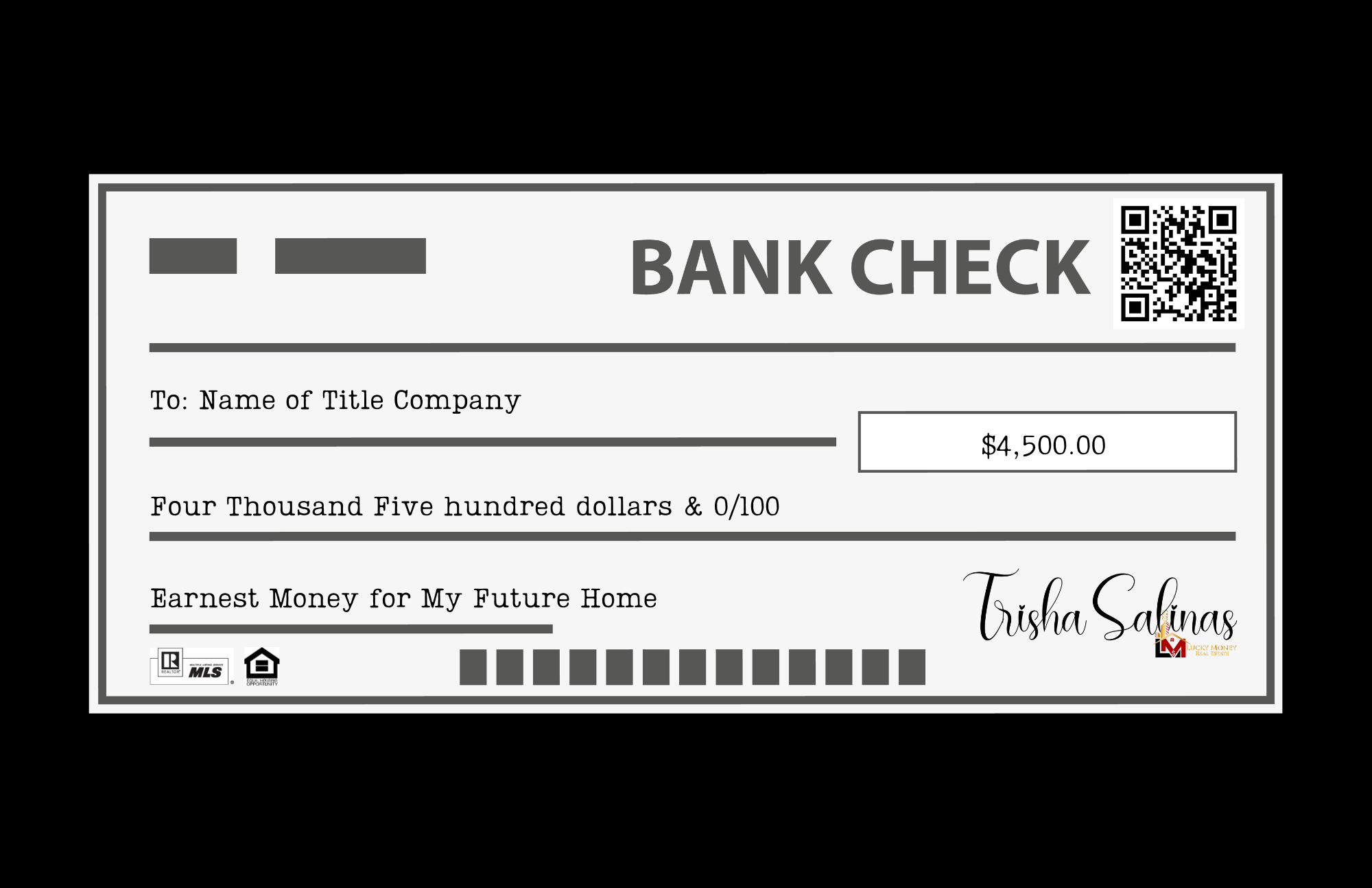

In real estate, a financing contingency is a contractual clause that buyers include in a purchase agreement. It's like a safeguard of their interests concerning property financing. This contingency outlines specific conditions that the sale must meet before progressing. Its purpose is to guarantee that if buyers are unable to secure appropriate property financing, they have the option to withdraw from the deal while retaining their earnest money deposit.

But don't worry! By the end of this post, you'll clearly understand the financing contingency and the concept of secure financing. With this knowledge, you'll be more prepared to navigate the process and protect your interests as you inch closer to owning your dream home.

Key Takeaways

- This clause in the purchase agreement protects the buyer if they can't secure financing. It lets you back out of a deal without losing your earnest money deposit.

- With this clause, you could retain your earnest money deposit and potentially avoid a lawsuit from the seller if you can secure financing and complete the purchase.

- This involves obtaining a mortgage loan from a lender, typically a pre-approval stage and a final approval stage.

- If you fail to secure financing during the final approval stage, the financing contingency clause allows you to back out of the sale.

Understanding Financing Contingency

So, what exactly is a financing contingency?

A financing contingency clause in the purchase agreement safeguards the buyer if they cannot secure financing. It's like a safety net that allows you to back out of a sale without legal repercussions or loss of earnest money if you can't get a loan.

The financing contingency clause says: "This deal depends on the buyer getting a mortgage." If you, as the buyer, can't get a mortgage for some reason, the clause allows you to walk away from the deal with your earnest money deposit intact.

Why is a Financing Contingency Important?

Buying a home is one of the most significant financial commitments you'll ever make. The last thing you want is to find yourself legally tied to a purchase you can't afford because you couldn't secure financing.

Without a financing contingency, if you fail to get a loan, not only would you lose your earnest money deposit (which can be a substantial amount), but the seller could sue you for not fulfilling your contractual duties.

The Process of Securing Financing

Securing financing is obtaining a mortgage to purchase a home. It involves finding a lender, getting pre-approved, and, eventually, receiving the final approval for the loan.

1. Pre-Approval Stage: Savvy buyers often get pre-approved for a mortgage before house hunting. During this stage, a lender evaluates your creditworthiness - your credit score, income, and debts - and then estimates how much they'd be willing to lend you. This pre-approval can give you a ballpark budget for house hunting and strengthen your bargaining position

2. Final Approval: Once you're under contract for a house, the lender will conduct a more in-depth review. They'll require more detailed financial information, and an appraiser will assess the value of the home you want to buy. If everything checks out, the lender will finalize your loan.

How Financing Contingency Protects You

But what happens if, despite your best efforts, you need to secure financing? That's where the financing contingency clause shines.

For example, imagine you're under contract for a house. You've been pre-approved based on your credit score and income. But when the lender delves more profoundly, they discover an old debt that affects your debt-to-income ratio negatively. As a result, they can't give you a loan.

In such a scenario, a financing contingency clause would allow you to back out of the sale, keeping your earnest money deposit safe. Without this clause, you'd be in a complicated and costly situation.

FAQs

What is a financing contingency?

A financing contingency clause in a real estate contract allows the buyer to back out of the deal if they cannot secure suitable financing for the property purchase.

Why is a financing contingency important?

A financing contingency protects buyers from being obligated to complete the purchase if they cannot obtain a mortgage or loan.

When is a financing contingency typically used?

Buyers include a financing contingency when making an offer on a property, especially when they need a mortgage to fund the purchase.

What conditions are outlined in a financing contingency?

A financing contingency may specify the type of loan, interest rate, loan amount, and the timeline for securing financing.

Wrapping Up

A financing contingency in your purchase agreement can provide peace of mind as you navigate the often unpredictable home-buying journey. It's like a safety rope that holds you firm when things get shaky.

Remember, the clause is more than just a complicated real estate term – it's your safeguard. It protects your interests and hard-earned money, allowing you to leave a deal if you can't secure financing. Start by knowing your credit score, understanding your budget, and getting a pre-approval letter from a lender.

Buying a house is an exhilarating journey, and understanding the ins and outs of the process, like financing contingency and secure financing, can help ensure that your experience is more exciting than stressful.

Now let's get started on your house hunting!

Trisha Salinas, Lucky Money Real Estate

(936) 520-6509